How I Built a Smarter Portfolio: My System for Steady Returns

What if your money could work harder without taking wild risks? I used to chase high returns, only to get burned. Then I shifted focus—building a balanced portfolio that prioritizes consistency over hype. This isn’t about get-rich-quick schemes. It’s about systematic asset allocation, real-world adjustments, and avoiding costly mistakes. Here’s how I redesigned my approach to return planning—and why it’s making a difference. The journey wasn’t dramatic, but it was transformative. I stopped trying to beat the market and started working with it. Instead of reacting to every headline, I built a system that responds to my life, not the noise. This shift didn’t just protect my savings—it helped them grow with confidence and clarity.

The Wake-Up Call: Why Chasing Returns Backfired

For years, I measured investment success by one number: the return percentage. If a stock was up 20% in a quarter, I saw it as a win. If my portfolio outperformed a friend’s, I felt accomplished. But that mindset came at a cost. In 2018, during a sharp market correction, I watched helplessly as gains from the previous year evaporated. What I thought was progress turned out to be illusionary—built on volatility, not value. I had concentrated too much in high-growth tech stocks, assumed past performance would continue, and ignored warning signs. When the downturn hit, I panicked and sold near the bottom, locking in losses. That experience was my wake-up call. I realized I wasn’t investing—I was speculating.

The truth is, chasing returns often means ignoring risk. High returns usually come with high volatility, and without a plan to manage that risk, even strong gains can vanish quickly. I had fallen into the trap of return-focused thinking, where the allure of quick profits overshadowed long-term stability. I wasn’t asking the right questions: What’s the likelihood of loss? How would I react in a downturn? Was my portfolio aligned with my actual financial goals? These are the questions that matter. After that painful lesson, I stepped back and redefined what success meant. Instead of asking, “How much can I make?” I began asking, “How can I protect what I have while growing it responsibly?”

That shift in mindset led me to explore more structured approaches. I started reading about asset allocation, risk-adjusted returns, and long-term compounding. I discovered that the most successful investors weren’t the ones making bold bets—they were the ones avoiding big mistakes. I learned about the concept of drawdowns, or the peak-to-trough decline in portfolio value, and how minimizing them is just as important as maximizing gains. This understanding changed everything. I began to see my portfolio not as a collection of individual investments, but as a system designed to function together. The goal was no longer to win every quarter, but to avoid catastrophic losses and compound steadily over time. That’s when I committed to building a smarter, more resilient strategy.

Rethinking Return Planning: Stability Over Spectacle

Once I accepted that chasing high returns wasn’t sustainable, I had to rebuild my approach from the ground up. I started by redefining what “return planning” really meant. For me, it was no longer about hitting aggressive targets or matching market highs. Instead, it became about achieving consistent, predictable growth that matched my life stage and financial responsibilities. I was in my late 40s, raising two children, and thinking about retirement. I didn’t need 20% annual returns—I needed stability, protection against inflation, and a reliable path to financial independence. That clarity allowed me to design a strategy based on realism, not fantasy.

I began by mapping out my financial goals with specific timelines. I listed short-term needs like emergency savings and home repairs, mid-term goals like funding college tuition, and long-term objectives like retirement income. For each, I estimated the amount needed and the time horizon. This exercise helped me understand how much risk I could actually afford to take. For goals less than five years away, I prioritized capital preservation. For those ten or more years out, I could accept more volatility in exchange for growth potential. This goal-based framework became the foundation of my return planning.

I also assessed my risk tolerance—not just how I felt during market swings, but how much loss I could sustain without derailing my plans. I used a simple rule: I wouldn’t invest money in stocks that I might need within the next five years. This self-imposed constraint kept me from overreaching. I accepted that I might miss out on some short-term gains, but I also knew I wouldn’t be forced to sell at a loss when life demanded cash. This balance between ambition and caution became central to my strategy. I stopped comparing my returns to market indices or friends’ portfolios. Instead, I measured success by how well my portfolio supported my real-life goals.

Another key insight was the power of compounding when protected from large losses. A portfolio that earns 7% annually with minimal drawdowns will outperform one that earns 10% but suffers a 30% drop every few years. Why? Because recovering from a 30% loss requires a 43% gain just to break even. By focusing on smoother, more consistent returns, I could compound wealth more efficiently. This principle became the cornerstone of my new approach: stability over spectacle. I no longer sought dramatic wins. I sought durable, uninterrupted growth.

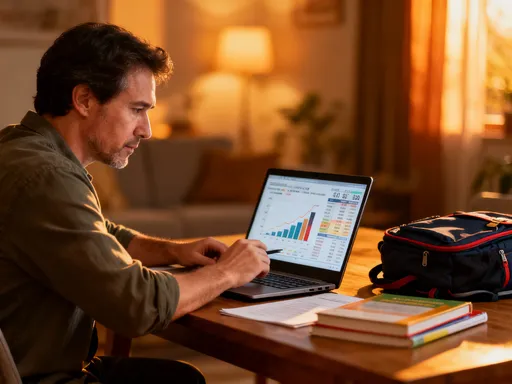

Building the Framework: My Core Asset Allocation Strategy

With my goals and risk tolerance defined, I turned to the structure of my portfolio. I needed a framework that would keep me disciplined and aligned with my objectives. I settled on a bucket strategy, dividing my assets into four functional categories: growth, income, protection, and liquidity. Each had a clear purpose and a designated allocation. This wasn’t a rigid formula, but a flexible guide that could evolve with my life and the economy.

The growth bucket, making up about 50% of my portfolio, was designed for long-term appreciation. I filled it with a mix of domestic and international equities, favoring low-cost index funds for broad market exposure. I avoided individual stock picking, knowing that even professionals struggle to beat the market consistently. Instead, I trusted the power of diversification and compounding across thousands of companies. Within this bucket, I maintained a balance between large-cap, mid-cap, and small-cap stocks to capture different stages of economic growth.

The income bucket, at 25%, focused on generating steady cash flow. I allocated this to high-quality bonds, including U.S. Treasuries, municipal bonds, and investment-grade corporate bonds. I also included a small portion in dividend-paying stocks from stable industries like utilities and consumer staples. These assets provided regular interest and dividends, which I could reinvest or use to cover living expenses in retirement. The key was reliability—these weren’t high-yield, high-risk bonds, but dependable instruments that held value during downturns.

The protection bucket, at 15%, served as a shock absorber. I used inflation-protected securities like TIPS, gold ETFs, and a small allocation to alternative assets such as real estate investment trusts (REITs). These assets don’t always rise when stocks do, which is exactly their purpose—they provide balance when traditional markets struggle. I didn’t expect them to deliver high returns, but I valued their role in preserving purchasing power and reducing overall portfolio volatility.

Finally, the liquidity bucket, at 10%, ensured I always had access to cash. This included a high-yield savings account, money market funds, and short-term CDs. I kept enough here to cover one year of living expenses, so I wouldn’t need to sell investments in a crisis. This buffer gave me peace of mind and eliminated the need to time the market. Knowing I had liquidity allowed me to stay invested for the long term, even during recessions.

Diversification Done Right: Beyond Just Spreading Risk

Early in my investing journey, I thought I was diversified because I owned stocks in different sectors. I had tech, healthcare, and energy stocks—surely that was enough. But I soon learned that true diversification isn’t just about holding multiple assets; it’s about holding assets that behave differently under various market conditions. During the 2008 financial crisis, for example, nearly all stock sectors fell together. Owning ten stocks in a falling market doesn’t protect you if they’re all correlated.

I began to study correlation—the degree to which assets move in relation to each other. I realized that effective diversification requires combining assets with low or negative correlations. When stocks fall, bonds often rise. When inflation spikes, real assets like gold or real estate may hold value. By understanding these relationships, I could build a portfolio where losses in one area might be offset by gains in another. This doesn’t eliminate risk, but it reduces the severity of downturns.

I also expanded my diversification globally. I had been heavily invested in U.S. markets, assuming they were the safest bet. But history shows that no single country dominates forever. I gradually increased my international exposure, allocating about 30% of my equity investments to developed and emerging markets abroad. This gave me access to growth in regions with younger populations, rising middle classes, and expanding economies. It also reduced my dependence on the U.S. dollar and Federal Reserve policy.

Another lesson was that diversification must evolve. A portfolio that’s well-diversified today may become unbalanced over time due to market movements or life changes. I now review my allocations annually and make adjustments based on performance, economic outlook, and personal circumstances. For example, as I approach retirement, I’ve slowly reduced my equity exposure and increased bonds and cash. This life-stage adjustment helps me preserve capital when I’ll need it most. Diversification isn’t a one-time task—it’s an ongoing process of refinement and rebalancing.

Risk Control: The Silent Engine of Long-Term Gains

Most investors talk about returns, but the real secret to long-term success is risk control. I’ve come to see risk management not as a constraint, but as the engine that powers sustainable growth. Without it, even the best returns can be wiped out in a single downturn. I now treat risk control as a core component of my strategy, equal in importance to asset selection.

One of my most effective tools is rebalancing. I set rules to review my portfolio every six months. If any asset class has drifted more than 5% above or below its target allocation, I buy or sell to restore balance. For example, if stocks have a strong year and now make up 58% of my portfolio instead of 50%, I sell some equities and buy bonds to bring it back in line. This forces me to “sell high and buy low,” a principle that’s simple in theory but hard to execute emotionally. Rebalancing removes emotion from the process and keeps my risk level consistent.

I also set drawdown boundaries—maximum acceptable losses for different parts of my portfolio. If my equity holdings fall by 15% from their peak, I pause and reassess. This doesn’t mean I sell automatically, but it triggers a review of my assumptions and strategy. Sometimes, it’s a signal to rebalance or adjust allocations. Other times, it’s a reminder to stay the course. These boundaries act as guardrails, preventing me from losing too much in a downturn.

Additionally, I use non-traditional hedges that don’t rely on market timing. For instance, I hold a small position in long-term Treasury bonds, which tend to rise in value during stock market declines. I also keep a portion in gold, which has historically preserved wealth during periods of high inflation or financial uncertainty. These assets don’t always perform well, but they serve a purpose when other parts of my portfolio are under stress. I don’t expect them to generate high returns—I expect them to reduce overall risk.

Another key practice is stress testing. I periodically simulate how my portfolio would perform under different scenarios—like a 20% market drop, a spike in interest rates, or a prolonged recession. This helps me understand my vulnerabilities and make adjustments before a crisis hits. For example, after seeing how rising rates could hurt bond values, I shifted to a laddered bond strategy, where I hold bonds with staggered maturities. This reduces interest rate risk and provides more predictable income.

Real Moves, Real Results: Adjustments That Made a Difference

Knowledge is valuable, but action is what creates results. Over the past five years, I’ve made several key changes to my portfolio based on this structured approach. One of the first was reducing my speculative holdings—those small-cap growth stocks and crypto investments that had once seemed exciting. I sold most of them and reinvested the proceeds into broad-market index funds and high-quality bonds. It wasn’t easy; some of those assets continued to rise. But I reminded myself that my goal wasn’t to maximize short-term gains, but to build long-term stability.

I also increased my allocation to international bonds, which I had previously ignored. I learned that global bond markets offer diversification benefits and can perform well when U.S. bonds struggle. I started with a small position in a low-cost global bond ETF and gradually increased it to 10% of my fixed-income portfolio. This move helped cushion my returns during periods of dollar strength and rising U.S. interest rates.

Another impactful change was automating my rebalancing. I used to do it manually, which meant I sometimes delayed it due to procrastination or emotional hesitation. Now, I use a robo-advisor that monitors my portfolio and executes rebalancing trades automatically when thresholds are met. This has made the process more consistent and less prone to human error. I’ve also set up automatic contributions to my retirement accounts, ensuring I invest regularly regardless of market conditions—a practice known as dollar-cost averaging.

The results have been meaningful. Over the past five years, my portfolio has delivered an average annual return of 6.8%, with a maximum drawdown of 14% during the 2020 market crash—significantly less than the S&P 500’s 34% decline. More importantly, I’ve experienced less stress and greater confidence in my financial future. I no longer check my account daily or react to news headlines. I trust the system I’ve built. When I compare this to my old approach—chasing hot stocks and panicking in downturns—the difference is clear. Discipline and structure have outperformed emotion and speculation.

Staying the Course: Discipline in a World of Noise

The final piece of the puzzle is discipline. No strategy works if you abandon it when markets turn volatile or when a new “opportunity” grabs your attention. I’ve learned to stay grounded through routines, clear rules, and regular check-ins. I review my portfolio quarterly, but I don’t make changes unless there’s a strategic reason. I use a checklist to evaluate any potential adjustment: Does this align with my goals? Does it improve diversification? Does it increase risk beyond my tolerance? If the answer to any is no, I don’t act.

I’ve also minimized my exposure to financial media. I used to watch business news daily, thinking it would help me stay informed. Instead, it made me anxious and reactive. Now, I get my information from trusted, long-term focused sources and avoid sensational headlines. I remind myself that markets are driven by emotion in the short term, but by fundamentals over time. My job isn’t to predict the next move—it’s to stay aligned with my plan.

I’ve built rituals around my financial life. Every January, I review my goals, update my budget, and rebalance my portfolio. I discuss our financial plan annually with my spouse, ensuring we’re both on the same page. These routines create stability and prevent impulsive decisions. I’ve also accepted that I won’t get everything right. There will be years when my portfolio underperforms the market. But I measure success not by beating benchmarks, but by sleeping well at night and progressing toward my goals.

Discipline isn’t about perfection—it’s about consistency. It’s about showing up, following the plan, and trusting the process. In a world full of noise, distraction, and fear of missing out, that consistency is my greatest advantage. I don’t need to be the smartest investor. I just need to be the most disciplined. And that, I’ve learned, is what leads to lasting financial peace.

Building wealth isn’t about luck or timing—it’s about design. My journey taught me that sustainable returns come from structure, not shortcuts. By focusing on smart asset allocation, managing risk, and staying disciplined, I’ve created a portfolio that grows steadily without keeping me awake at night. It’s not flashy, but it’s effective. And that’s the kind of success that lasts.