How I Keep My Fun Spending From Wrecking My Finances

We all love concerts, streaming, travel, and dining out—but entertainment spending can quietly drain your wallet. I learned this the hard way after overspending on events and subscriptions. What started as small treats turned into a financial headache. That’s when I shifted my mindset: fun doesn’t have to be costly, and enjoyment shouldn’t come with guilt. In this article, I’ll walk you through how to enjoy entertainment wisely while keeping your money goals intact. The truth is, most people don’t realize how much they spend on leisure until it affects their savings or creates stress around bills. Entertainment feels harmless because it’s not groceries or rent, but repeated small choices can shift your financial trajectory. The good news is that with awareness, structure, and intention, you can have rich experiences without draining your account.

The Hidden Cost of Fun: Why Entertainment Spending Gets Out of Control

Entertainment spending often slips under the radar because it doesn’t feel like a necessity. Unlike mortgage payments or utility bills, a movie ticket or a night out seems minor in the moment. Yet, these expenses accumulate faster than most realize. A $15 streaming fee, a $20 concert drink package, a $10 food delivery tip—individually, they appear insignificant. But over time, such micro-spendings form a steady leak in personal finances. According to a 2023 report by the Bureau of Labor Statistics, American households spend an average of $3,000 annually on entertainment, including dining out, subscriptions, and recreational events. For many, that amount could cover an emergency fund contribution or a significant portion of a vacation budget.

One of the main reasons entertainment spending spirals is emotional decision-making. When you're with friends, excited about a concert, or simply tired after work, rational budgeting fades into the background. The brain treats small expenses as “exceptions,” especially when using cards or digital payments. Without physical cash changing hands, the psychological impact of spending weakens. This creates a phenomenon known as “payment decoupling,” where the act of paying feels less painful, making overspending easier. A coffee stop before work becomes two stops. A quick dinner out becomes three meals a week. What begins as occasional fun evolves into routine spending without conscious approval.

Social pressure also plays a powerful role. The fear of missing out—commonly referred to as FOMO—drives many to attend events they can’t afford or maintain subscriptions they rarely use. Seeing others post about concerts, weekend getaways, or exclusive dining experiences can trigger a sense of obligation to participate. This isn’t just about vanity; it’s deeply tied to human connection and belonging. However, when social enjoyment consistently overrides financial boundaries, the cost isn’t just monetary—it’s peace of mind. Over time, unchecked entertainment spending leads to guilt, stress, and delayed financial goals like saving for a home or retiring comfortably.

Another overlooked factor is the normalization of convenience. In today’s digital world, buying tickets, ordering food, or subscribing to services takes seconds. One-click purchases and auto-renewals remove friction, which benefits user experience but harms financial control. A subscription trial that starts free can become a permanent charge if not monitored. An event promoted on social media can lead to an impulse buy before rational evaluation kicks in. These systems are designed to encourage consumption, not caution. Without deliberate oversight, even financially aware individuals can fall into spending patterns that don’t align with their long-term objectives.

Redefining Value: Separating Want from Worth in Leisure Choices

To regain control, it’s essential to distinguish between what you want and what you truly value. Not all entertainment delivers equal satisfaction. Some activities leave you energized and fulfilled; others leave you questioning why you spent the time and money. The key is intentional consumption—evaluating each leisure expense based on the joy, connection, or rejuvenation it provides. This shift moves spending from automatic to purposeful, allowing you to eliminate waste without sacrificing happiness.

Consider two concert scenarios. In the first, you buy tickets to see your favorite band perform live—a dream you’ve had for years. The experience is memorable, emotionally powerful, and something you talk about for months. In the second, you attend a trendy artist’s show because your coworkers are going. The music is okay, the venue is crowded, and you’re home by 10 p.m. feeling underwhelmed. Both cost $120, but only one delivered lasting value. The difference lies in alignment with personal meaning. When spending reflects your authentic interests, it feels justified and rewarding. When it stems from habit or social influence, it often leads to regret.

This principle applies across all forms of entertainment. Dining out can be a joyful family tradition or a lonely habit fueled by exhaustion. Streaming services offer endless content, but how many shows do you actually finish? A weekend getaway can refresh your spirit or become a source of stress if overbooked and overpriced. The goal isn’t to stop spending—it’s to spend where it matters most. By asking simple questions before each purchase—“Will this bring me real joy?” “Am I doing this for me or because of pressure?”—you begin to filter out low-value expenses.

Another effective strategy is to think in terms of opportunity cost. Every dollar spent on entertainment is a dollar not saved, invested, or used for future goals. If you spend $50 monthly on underused apps, that’s $600 a year—enough for a flight or a high-quality kitchen appliance. Viewing leisure spending through this lens helps balance immediate pleasure with long-term priorities. It’s not about deprivation; it’s about awareness. When you consciously choose where to allocate your entertainment budget, you gain confidence in your decisions and reduce post-purchase guilt.

Some find it helpful to assign emotional ratings to past experiences. After attending an event or using a service, rate it from 1 to 10 based on enjoyment. Over time, patterns emerge. You might discover that low-cost activities like picnics, local festivals, or game nights bring higher satisfaction than expensive outings. This data-driven reflection supports smarter future choices. Ultimately, redefining value means treating your entertainment budget like a curated experience fund—focused on quality, not quantity.

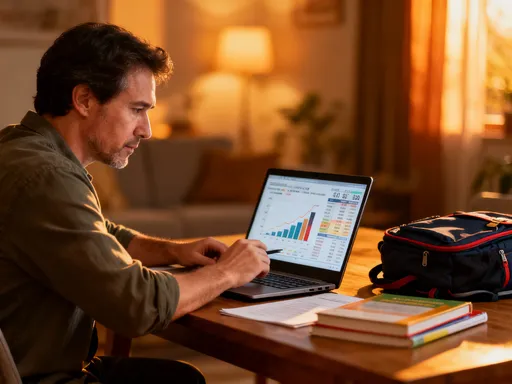

Budgeting Without Bitterness: Building a Smart Entertainment Allowance

Strict budgets often fail because they feel punitive. Telling yourself “no more dining out” or “no concerts this year” may work briefly, but deprivation usually leads to rebellion. A more sustainable approach is to create a flexible entertainment allowance—a designated portion of income set aside for leisure. This method, rooted in behavioral finance, acknowledges that people need enjoyment to stay motivated and balanced. The goal isn’t elimination but moderation with intention.

Start by reviewing your current spending. Look at bank statements, credit card summaries, or budgeting apps to identify how much you’ve spent on entertainment over the past three to six months. Calculate the average monthly total. Then, assess your financial goals. Are you saving for a house? Paying off debt? Building an emergency fund? Based on your priorities, decide how much you can realistically allocate to fun without compromising stability. For most households, 5% to 10% of net income is a reasonable range for discretionary spending, including dining, events, and subscriptions.

Once you set the amount, treat it like any other budget category. Transfer the funds to a separate account or label them in your budgeting tool. This creates psychological separation, making it easier to track and manage. Divide the allowance into subcategories—such as streaming, dining, events, and hobbies—based on your preferences. For example, if you love music but rarely go to movies, allocate more to concerts and less to streaming. Flexibility within the total cap allows for personalization without overspending.

Tracking doesn’t have to be complicated. Use simple tools like mobile apps, spreadsheets, or even a notebook. Record each entertainment expense as it happens. At the end of the month, review what you spent and how satisfied you were. Did the money go toward high-value experiences? Were there impulse buys that didn’t deliver? This reflection strengthens decision-making over time. The act of tracking also increases mindfulness, reducing the likelihood of unconscious spending.

Another benefit of a structured allowance is the ability to plan ahead. If you know a concert is coming up, you can save incrementally by adjusting other areas of your entertainment budget—watching fewer paid streams or postponing a restaurant visit. This turns spontaneous joy into intentional celebration. Over time, this system fosters a sense of control rather than restriction. You’re not saying “I can’t afford this”; you’re saying “I’m choosing to spend my entertainment dollars here.” That subtle shift builds financial confidence and reduces emotional conflict around money.

Subscription Traps: How to Tame the Auto-Pay Beast

Recurring charges are one of the biggest silent budget killers. Unlike one-time purchases, subscriptions renew automatically, often without notice. What starts as a free trial or a useful service can become a permanent expense, especially when multiple platforms are involved. Streaming, fitness apps, meal kits, cloud storage, and gaming memberships all fall into this category. The convenience of auto-pay is also its danger—it removes the need to reevaluate whether the service is still valuable.

A 2022 study by West Monroe found that the average American subscribes to nearly five streaming services, spending over $80 per month. When combined with music, fitness, and delivery subscriptions, the total can exceed $150. For many, this is equivalent to a car payment or a significant grocery bill—yet it often goes unquestioned. The problem isn’t the services themselves but the lack of regular assessment. People continue paying for platforms they use once a month or forget entirely.

To regain control, conduct a subscription audit. Gather all your accounts—bank statements, digital wallets, and app store histories—and list every recurring charge. Categorize them by type and cost. Then, evaluate each one: How often do you use it? Does it bring real value? Could you access similar content elsewhere? Be honest. If you haven’t logged into a service in 60 days, it’s likely not essential. Canceling unused subscriptions can free up hundreds annually with zero impact on lifestyle.

For services you do enjoy, consider rotation strategies. Instead of maintaining five streaming platforms year-round, subscribe to one or two at a time. Watch what you want, cancel, then switch to another. Many services allow easy reactivation, so you’re not losing access—just timing it better. This approach works well for seasonal interests, like fitness programs in January or travel platforms before a trip. It turns subscriptions from fixed costs into flexible tools.

Sharing plans ethically is another effective tactic. Many streaming and cloud services offer family options for up to six people. Splitting the cost with trusted relatives or roommates can cut individual expenses by 50% or more. Just ensure everyone respects login limits and content preferences. Avoid sharing payment methods directly; instead, have one person manage the account and collect contributions separately to prevent billing confusion.

Free trials should be used strategically, not impulsively. Set calendar reminders for trial end dates to avoid accidental charges. Use trials to test services thoroughly—explore features, watch key content, and assess usability. If it doesn’t meet your needs, cancel before billing starts. Some platforms make cancellation difficult, so research the process in advance. The goal is to be in control, not trapped by fine print.

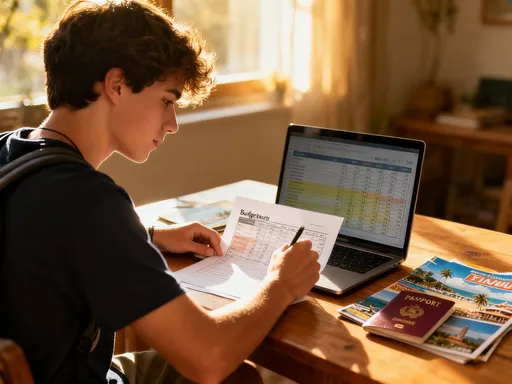

The Timing Game: When to Splurge (and When to Skip)

Timing plays a crucial role in both cost and satisfaction. A well-timed purchase can save money and enhance enjoyment, while an impulsive one often leads to regret. Learning to recognize the right moment to spend—and when to wait—can transform your entertainment budget from reactive to strategic.

For travel and events, booking early usually means better prices. Airlines, hotels, and concert venues often release tickets at lower rates months in advance. As dates approach, demand increases, and so do prices. Planning a trip six months ahead can save 20% to 40% compared to last-minute bookings. Similarly, buying concert or theater tickets during presales or initial releases avoids resale markups. Setting calendar alerts for sale dates helps you act quickly without overthinking.

Off-season travel offers another opportunity to save. Popular destinations like beach towns or ski resorts drop prices significantly during quieter months. A summer beach rental might cost $3,000 in July but only $1,200 in May. With flexible schedules, families can enjoy the same experiences at a fraction of the cost. Even local attractions often offer discounts during slower periods. These savings can be redirected toward better accommodations, dining, or activities, enhancing the overall experience.

Rewards and loyalty programs also depend on timing. Credit card points, airline miles, and cashback apps are most valuable when used strategically. Accumulate points over several months, then redeem them for high-cost items like flights or concert packages. Some cards offer bonus categories for dining or travel—aligning purchases with these periods maximizes returns. However, never spend extra just to earn rewards. The benefit is in optimizing existing spending, not inflating it.

Emotional timing matters just as much as financial timing. Avoid making entertainment purchases during periods of stress, sadness, or excitement. Emotional highs—like a work bonus or a social media highlight—can distort judgment, leading to overspending. Similarly, using shopping or dining out as a coping mechanism for stress creates a cycle of temporary relief followed by financial anxiety. Instead, practice the 24-hour rule: wait one day before booking non-essential events or subscriptions. This pause allows rational thinking to return, often revealing whether the purchase is truly necessary.

Delayed gratification doesn’t mean denying yourself. It means converting impulsive acts into planned rewards. If you want front-row concert tickets, start saving six months in advance. When the day comes, the experience feels earned and more satisfying. This approach builds financial discipline while preserving joy. Over time, you’ll find that waiting doesn’t diminish excitement—it enhances it.

Earning While Enjoying: Creative Ways to Offset Costs

Entertainment doesn’t have to be purely an expense. With a bit of creativity, some leisure activities can generate value or reduce net spending. The goal isn’t to turn every hobby into a business but to find ethical, low-effort ways to balance the financial equation.

One practical method is reselling tickets. If you can’t attend an event you’ve already paid for, list the tickets on official resale platforms. Many concert venues and sports arenas offer verified resale options that protect both buyer and seller. While you may not recover the full cost, recouping even 60% reduces the financial sting. The same applies to unused gift cards or event vouchers—online marketplaces allow safe exchanges at discounted rates.

If you have a skill that complements your hobbies, consider occasional monetization. A photographer who loves concerts might sell event photos to attendees or local blogs. A craft enthusiast could sell handmade goods at community fairs tied to festivals they enjoy. These activities should enhance, not replace, the joy of participation. Set clear boundaries—limit time spent and avoid pressure to profit. The focus remains on sustainability, not income generation.

Cashback and rewards apps also help offset costs. Apps like Rakuten, Ibotta, or credit card portals offer rebates on dining, streaming, and ticket purchases. While individual returns are small—typically 1% to 5%—they accumulate over time. Apply rebates directly to your entertainment budget or savings goals. Some users redirect all cashback earnings into a “fun fund,” creating a self-replenishing source of guilt-free spending.

Another overlooked strategy is leveraging employer or community benefits. Some companies offer discounted tickets to cultural events, gyms, or travel packages as part of wellness programs. Libraries provide free access to streaming platforms, audiobooks, and even museum passes. Local community centers host low-cost classes and social events. These resources expand entertainment options without adding to expenses. Being aware of available benefits ensures you’re not paying for what you can get for free or at a discount.

The key is balance. Monetizing hobbies should never feel like work. If an activity starts causing stress or obligation, scale back. The purpose is to reduce net spending, not create new pressure. When done mindfully, these strategies support financial health while preserving the joy of leisure.

Long-Term Mindset: Linking Fun to Financial Peace, Not Regret

True financial well-being isn’t measured by how little you spend on fun but by how aligned your spending is with your values and goals. Discipline isn’t about cutting out joy—it’s about making room for meaningful experiences without compromising security. When entertainment is managed with intention, it becomes a source of enrichment rather than regret.

Consistency matters more than perfection. No one maintains a perfect budget every month. There will be times when you overspend or make an impulse decision. What counts is the overall trend. Regular reflection, small adjustments, and self-compassion keep you on track. Celebrate progress, not just outcomes. If you reduced subscription waste by 30%, that’s a win. If you enjoyed a concert without derailing your savings, that’s success.

Over time, disciplined entertainment habits build financial confidence. You stop dreading account checks and start feeling in control. Money stress decreases, freeing mental energy for family, creativity, and personal growth. This peace of mind supports larger goals—buying a home, funding education, retiring early. Every dollar wisely spent on fun is a dollar that didn’t sabotage a dream.

Ultimately, the goal is balance. Life is meant to be enjoyed, not endured. By setting boundaries, evaluating value, and planning strategically, you can have rich experiences without financial strain. Fun and financial health aren’t opposites—they’re partners in a fulfilling life. When you spend with purpose, every dollar carries meaning. And that’s the true definition of financial freedom.