How I Cracked Early Retirement Without Winning the Lottery

What if retiring in your forties wasn’t just for tech founders or heirs? I’m a regular professional who left the 9-to-5 grind by forty-two, not through luck, but through a repeatable financial strategy. This isn’t about get-rich-quick schemes—it’s about smart trade-offs, invisible costs, and compounding patience. I’ll walk you through the real moves, mistakes, and turning points that made it possible—no hype, just reality. It started not with a windfall, but with a quiet realization: time is the one resource I couldn’t earn back. The years were passing, and I was trading them for a paycheck that never seemed to keep pace with the life I wanted. The turning point came when I realized that financial independence wasn’t about luxury, but about liberty—the freedom to choose how I spent my days, who I spent them with, and what kind of legacy I wanted to build. This is how I got there.

The Breaking Point: Why Early Retirement Stopped Being a Dream

For most of my thirties, retirement was a distant concept, something to be addressed “later.” I saved a little, contributed to my employer’s retirement plan, and told myself I was on track. But “on track” meant following the default path: work until sixty-five, hope the market cooperates, and cross my fingers that health and energy hold out. Then, everything changed. A close friend was diagnosed with a serious illness in her early forties. She wasn’t reckless with money—she had a stable job, a home, and retirement accounts. But she wasn’t financially independent. Her recovery meant months off work, mounting medical bills, and a complete loss of control over her time. Watching her struggle wasn’t just heartbreaking; it was a mirror. I realized I was one crisis away from the same fate. At the same time, I was experiencing my own burnout. The long hours, the constant pressure, the feeling that I was running in place—it was taking a toll on my health and relationships. I began to question the trade-off: was a comfortable salary worth sacrificing my most vibrant years? The rising cost of living only sharpened the urgency. Inflation was eroding my purchasing power, and my savings weren’t growing fast enough to keep up. That’s when I stopped thinking of early retirement as a fantasy and started treating it as a necessity. It wasn’t about escaping work forever; it was about building a life where I wasn’t dependent on it. This shift in mindset was the first real step toward freedom. I began to see money not as a measure of success, but as a tool to buy back my time. And time, I realized, was the ultimate currency.

The emotional weight of this realization was heavy, but it also brought clarity. I no longer wanted to wait for a permission slip from age or society to live on my own terms. I wanted control—not just over my finances, but over my days, my energy, and my priorities. This wasn’t about rejecting responsibility; it was about redefining it. I had a family to support, bills to pay, and goals to achieve. But I also had a right to design a life that didn’t leave me drained and disconnected. The path to early retirement became less about retiring early and more about achieving independence earlier. I started asking different questions: How much do I really need to live well? What expenses are truly essential? How can I create income that doesn’t require my constant presence? These weren’t abstract ideas—they became the foundation of a new financial strategy. I began tracking every dollar, analyzing my cash flow, and identifying where my money was leaking. I read books, studied personal finance blogs, and connected with others who had walked this path. What I discovered was both encouraging and humbling: early retirement wasn’t reserved for the ultra-rich or the lucky few. It was achievable through discipline, smart planning, and a willingness to make unconventional choices. The journey wasn’t about deprivation; it was about alignment—aligning my spending with my values, my work with my purpose, and my financial habits with my long-term vision.

Redefining the Goal: What Early Retirement Actually Means (It’s Not What You Think)

When most people hear “early retirement,” they imagine beach vacations, endless leisure, and a complete exit from all forms of work. But for me, and for many who achieve financial independence, it looks very different. Early retirement isn’t about doing nothing—it’s about doing what matters. It’s about having the freedom to choose work that’s meaningful, rather than obligatory. It’s about being able to say no to opportunities that don’t align with your values, and yes to experiences that enrich your life. The core idea is financial independence: having enough passive income to cover your essential living expenses without relying on a paycheck. This doesn’t mean you stop working altogether. In fact, many people in early retirement continue to work part-time, consult, or pursue passion projects—just without the pressure of needing the income. The key is optionality. When your basic needs are met through investments, savings, and other income streams, you gain the power to shape your time intentionally.

This distinction is crucial. Financial independence is not the same as being rich. You don’t need millions to achieve it—just enough to live comfortably within your means. For some, that might mean a modest lifestyle in a low-cost area. For others, it might mean maintaining a higher standard of living but with strict budgeting and efficient use of resources. The goal isn’t to accumulate wealth for its own sake, but to create a sustainable financial foundation that supports the life you want. This requires a clear understanding of your expenses, especially the fixed ones: housing, healthcare, food, transportation, and insurance. Once you know your annual cost of living, you can calculate how much capital you need to generate that income reliably. A common rule of thumb is the 4% rule, which suggests that if you withdraw 4% of your portfolio annually, it should last at least 30 years, assuming a balanced mix of stocks and bonds. So, if your annual expenses are $40,000, you’d need a portfolio of about $1 million. But this isn’t a one-size-fits-all formula. Market conditions, inflation, and personal risk tolerance all play a role. The point is to have a realistic target based on your actual lifestyle, not someone else’s version of success.

Another misconception is that early retirement means leaving the workforce at a specific age. In reality, it’s more about achieving a state of readiness. Some people transition gradually, reducing their hours or switching to freelance work before fully stepping away. Others take a “semi-retirement” approach, working seasonally or on projects that interest them. The timeline is less important than the foundation. What matters is that you’ve built enough resilience into your financial plan to withstand unexpected events—market downturns, medical emergencies, or changes in personal circumstances. This requires more than just saving money; it demands a holistic approach that includes risk management, tax efficiency, and ongoing financial education. By redefining early retirement as a process rather than a destination, you free yourself from arbitrary deadlines and focus on building lasting security. It’s not about quitting your job tomorrow; it’s about creating the conditions where you can choose to quit, if and when you want to.

The Foundation: Building a Reliable Income Engine

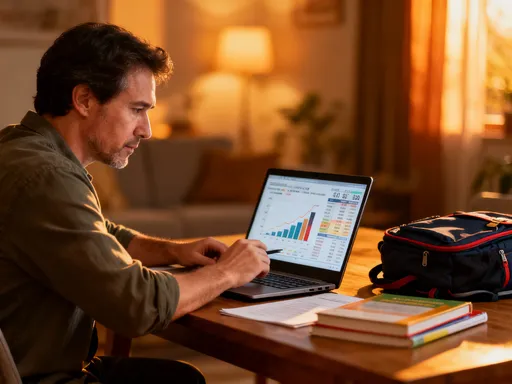

The cornerstone of early retirement is a reliable income engine—one that continues to generate returns even when you’re not actively working. For me, this meant shifting from a single source of income (my salary) to multiple, diversified streams. The first step was maximizing contributions to tax-advantaged retirement accounts. I took full advantage of my employer’s 401(k) plan, contributing enough to get the full match, and then increasing my contributions every time I received a raise. I also opened a Roth IRA and funded it annually, appreciating the flexibility of tax-free withdrawals in retirement. These accounts provided a strong base, but they weren’t enough on their own. I needed growth, and that meant investing in assets that could compound over time. I chose low-cost index funds, which offer broad market exposure with minimal fees. Studies have consistently shown that most actively managed funds fail to beat the market over the long term, so I opted for simplicity and consistency. By investing in total stock market and total bond market funds, I gained exposure to thousands of companies with a single transaction, reducing my risk and eliminating the need to pick individual stocks.

Over time, I expanded into real estate as a second pillar of my income strategy. This wasn’t about flipping houses or speculative development; it was about generating steady rental income from carefully vetted properties. I started small, purchasing a duplex where I lived in one unit and rented out the other. This allowed me to offset my housing costs while building equity. As my savings grew, I acquired additional rental properties in stable markets with strong tenant demand. I focused on cash flow—ensuring that each property generated positive income after all expenses, including maintenance, property taxes, insurance, and vacancies. Real estate added diversification to my portfolio and provided a hedge against inflation, since rents and property values tend to rise over time. But it also required active management, so I partnered with a reputable property management company to handle day-to-day operations. This allowed me to benefit from the income without being tied to maintenance calls or tenant issues. Real estate isn’t for everyone—illiquidity, market fluctuations, and management demands are real challenges—but for me, it complemented my stock investments and added stability to my overall financial picture.

Another critical element was minimizing emotional decision-making. The stock market will always have ups and downs, and it’s easy to panic during downturns. But history shows that staying the course is usually the best strategy. I built a portfolio allocation that matched my risk tolerance and stuck to it, rebalancing annually to maintain my target mix. I avoided chasing hot trends or trying to time the market—behaviors that often lead to losses. Instead, I focused on consistency: investing the same amount every month, regardless of market conditions. This dollar-cost averaging approach allowed me to buy more shares when prices were low and fewer when they were high, smoothing out volatility over time. I also automated my investments, setting up recurring transfers from my checking account to my brokerage and retirement accounts. This removed the temptation to delay or skip contributions during busy or stressful periods. Building a reliable income engine wasn’t about making brilliant moves; it was about making consistent, disciplined ones—and letting compounding do the heavy lifting.

The Hidden Tax: How Lifestyle Inflation Erodes Progress

One of the biggest obstacles to early retirement isn’t market risk or low returns—it’s lifestyle inflation. This is the tendency to increase spending as income rises, often without conscious awareness. When I got my first promotion and raise, I upgraded my car, moved to a nicer apartment, and started dining out more frequently. On paper, I was doing well. But in reality, I was eroding my ability to save and invest. These expenses became “normal,” and I stopped questioning whether they were worth the long-term cost. The problem with lifestyle inflation is that it’s invisible. A $5 daily coffee habit doesn’t seem like much, but over ten years, it adds up to over $18,000—not including interest. A $600 monthly car payment costs more than $7,000 a year, and over a decade, that’s nearly $90,000, assuming no investment growth. These are not trivial amounts. They represent years of delayed financial freedom.

I began tracking every expense, using a simple spreadsheet to categorize my spending. What I discovered was shocking: subscriptions I didn’t use, impulse purchases I didn’t remember, and recurring bills that had quietly increased over time. I was paying for multiple streaming services, a gym membership I rarely used, and software I no longer needed. I also realized how much I was spending on convenience—takeout, delivery fees, and last-minute purchases—often because I was too busy or stressed to plan ahead. This wasn’t frugality gone wild; it was financial awareness. I didn’t cut everything out—I still enjoyed dining out and traveling—but I became intentional about it. I canceled unused subscriptions, negotiated lower rates on insurance and internet bills, and started meal planning to reduce food waste and eating out. I also reevaluated big-ticket items. Instead of buying new cars every few years, I switched to reliable used vehicles and kept them longer. I downsized my living space, moving to a smaller home with lower property taxes and utility costs. These changes weren’t about deprivation; they were about alignment. I was redirecting money from things that didn’t matter much to me toward goals that did—freedom, security, and time with family.

The impact was transformative. By reducing my annual expenses by 25%, I significantly lowered the size of the nest egg I needed to retire. Using the 4% rule, every $10,000 I saved in annual expenses meant I needed $250,000 less in investments. That’s a powerful incentive to live below your means. But the benefits went beyond math. I felt more in control, more aware of my choices, and more connected to my financial goals. I stopped measuring success by possessions and started measuring it by progress. This shift in mindset made it easier to stick to my plan, even when it required short-term sacrifices. I learned that financial independence isn’t about earning more—it’s about needing less. And the less you need, the faster you can reach your goal. Lifestyle inflation isn’t inevitable. It’s a habit, and like any habit, it can be changed with awareness, discipline, and a clear sense of purpose.

Risk Control: Protecting Your Plan From Black Swans

No financial plan is complete without a strong risk management strategy. The path to early retirement is long, and along the way, unexpected events can derail even the most disciplined savers. Market crashes, job loss, medical emergencies, or family crises can wipe out years of progress if you’re not prepared. That’s why I built buffers into my plan from the beginning. The first and most important was an emergency fund. I saved six to twelve months’ worth of living expenses in a high-yield savings account, easily accessible but separate from my everyday spending. This fund wasn’t meant to earn high returns—it was meant to prevent me from selling investments at a loss during a downturn or going into debt during a crisis. It gave me peace of mind and flexibility, knowing I could handle short-term setbacks without jeopardizing my long-term goals.

Next came insurance. While I aimed to be self-reliant, I recognized that some risks are too large to absorb on my own. I maintained comprehensive health insurance, not just for medical coverage but to avoid catastrophic out-of-pocket costs. I also secured disability insurance, which would replace a portion of my income if I became unable to work due to illness or injury. Many people overlook this, but losing your ability to earn is one of the biggest threats to financial independence. I also carried adequate liability coverage, including umbrella insurance, to protect my assets in case of a lawsuit. These policies weren’t cheap, but they were a small price to pay for protection against worst-case scenarios. I reviewed my coverage annually, adjusting as my life circumstances changed—marriage, children, home ownership, and so on. Insurance isn’t an investment; it’s a safety net. And like any net, it’s only useful if it’s in place before you fall.

Portfolio allocation was another key element of risk control. I didn’t put all my money into stocks, no matter how high the potential returns. Instead, I built a diversified portfolio that balanced growth with stability. My allocation shifted over time, becoming more conservative as I approached my target retirement date. In my thirties, I was 80% in stocks and 20% in bonds. By my early forties, it was closer to 60/40. This reduced my exposure to market volatility while still allowing for growth. I also avoided concentrating my investments in a single company, sector, or country. Diversification doesn’t guarantee profits or prevent losses, but it reduces the impact of any one bad outcome. I also resisted the urge to make emotional changes during market swings. When the 2020 crash hit, I didn’t panic-sell. Instead, I saw it as an opportunity to buy more shares at lower prices. Staying disciplined during turbulence was one of the most important skills I developed. Risk can’t be eliminated, but it can be managed. By preparing for the unexpected, I made my plan more resilient and my journey more sustainable.

The Real Leverage: Time, Not Money, Is the Ultimate Asset

If there’s one advantage younger investors have, it’s time. Compounding doesn’t just grow your money—it multiplies it, but only if given enough years to work. I started investing seriously in my late twenties, and that decade of early growth made a massive difference. Consider this: if you invest $500 a month starting at age 25, with a 7% annual return, you’ll have over $1 million by age 60. But if you wait until 35 to start, you’ll have less than half that amount—around $470,000—despite investing the same amount each month. Delay it until 45, and you’ll have just over $200,000. The math is clear: starting early is the single most powerful factor in building wealth. It’s not about earning a high salary or finding the next hot stock; it’s about consistency and duration. Every year you delay costs you not just that year’s contributions, but all the future growth those contributions could have generated.

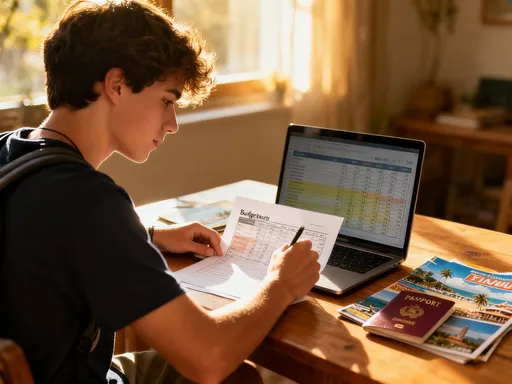

But time isn’t just about starting early—it’s also about how you use it during and after retirement. Many people assume early retirement means stopping work completely, but that’s not always necessary or desirable. I found that part-time work or side income during semi-retirement can dramatically reduce the amount of capital you need. If you can cover 30% of your expenses through consulting, freelancing, or a small business, your portfolio only needs to generate 70% of your income. That could mean retiring five or ten years earlier. It also keeps you engaged, socially connected, and mentally sharp. Purpose matters. Financial independence isn’t just about money; it’s about creating a life that feels meaningful. For some, that means volunteering, teaching, or mentoring. For others, it’s pursuing creative projects or traveling with intention. The key is to design a post-career life that aligns with your values, not just your budget.

Time also gives you flexibility. If you achieve financial independence in your forties, you’re not locked into a single path. You can take breaks, explore new interests, or even start over if you want to. You’re not trapped by the fear of losing income. This freedom allows for greater experimentation, learning, and personal growth. It’s not about doing less—it’s about doing what matters most. And because you’re no longer dependent on a paycheck, you can afford to take thoughtful risks, invest in experiences, and prioritize relationships. Time, once bought back, becomes the most valuable currency of all. It’s not just the foundation of early retirement—it’s the reward.

The Transition: From Planning to Living the New Reality

Reaching financial independence was a milestone, but the real challenge began when I stepped away from full-time work. After years of planning, budgeting, and sacrificing, I had to learn how to live differently. The first few months were disorienting. I missed the structure, the social interactions, and the sense of purpose that came with my job. I had to redefine my identity—not as a professional, but as a person with time and freedom. This transition required as much preparation as the financial side. I didn’t quit cold turkey. Instead, I reduced my hours, took on fewer projects, and tested what retirement would feel like. I called it a “trial run,” and it was invaluable. It helped me identify what I truly enjoyed, what I missed, and what adjustments I needed to make.

I focused on building a new routine—one that included physical activity, learning, and meaningful engagement. I joined community groups, volunteered regularly, and started a small garden. I also continued to work part-time as a consultant, not because I needed the money, but because I enjoyed the intellectual challenge and the connection to my field. This part-time income also provided a psychological buffer, reducing the pressure on my investment portfolio. I learned to manage my expectations. Retirement wasn’t a constant vacation; it had its mundane moments, just like any phase of life. But the difference was that I could choose how to fill those moments. I could read, travel, spend time with family, or learn a new skill—without asking for permission or worrying about deadlines.

Sustainability was my top priority. I didn’t want to return to work out of boredom or financial gaps. So I kept monitoring my budget, stayed informed about my investments, and remained flexible. I also made sure to maintain strong social connections, knowing that isolation can be a real risk in retirement. The goal wasn’t to escape life, but to live it more fully. And with time on my side, I could finally do that.

Freedom Isn’t Free—But It’s Within Reach

Looking back, early retirement wasn’t the result of a single brilliant decision, but of hundreds of small, consistent choices. It wasn’t about extreme frugality or risky bets; it was about clarity, discipline, and patience. I learned to distinguish between needs and wants, to live below my means, and to invest with purpose. I protected my plan from setbacks with emergency funds, insurance, and diversified income. I leveraged time as my greatest asset, starting early and staying the course. And when the day came to step away from full-time work, I was ready—not just financially, but emotionally and mentally.

Financial freedom isn’t a destination; it’s a way of living. It’s about having the resources and resilience to handle life’s uncertainties while pursuing what matters most. It’s not reserved for the wealthy or the lucky. It’s available to anyone willing to make intentional choices, delay gratification, and stay focused on long-term goals. You don’t need to win the lottery. You just need a plan, the courage to follow it, and the patience to let time do its work. Early retirement isn’t a fantasy—it’s a path, and it’s one you can walk, one deliberate step at a time.