Pass It On Without Paying the Price: My Real Talk on Smarter Business Succession

Inheriting a family business isn’t just about taking the reins—it’s about keeping it alive without draining your wallet. I’ve seen hardworking owners build empires, only to watch them crumble during transition. Why? Hidden costs, emotional decisions, and outdated strategies. But what if you could pass the torch smoothly while protecting profits and cutting unnecessary expenses? This isn’t theory—it’s real talk from experience. Let’s walk through how to make succession a smart, affordable move.

The Hidden Cost of Silence: Why Most Family Businesses Stumble at Succession

Many family businesses thrive for decades, yet collapse when it’s time to hand over leadership. The problem often isn’t the business—it’s the lack of planning. Emotions run high, roles blur, and financial inefficiencies pile up. Without clear structure, legal confusion and tax inefficiencies can eat into profits fast. This section explores real-world scenarios where silence or delay led to costly disputes, dropped valuations, and avoidable tax burdens. We’ll look at why pretending the transition will “just work out” is a dangerous gamble—and how early action protects both family and finances.

Consider a mid-sized manufacturing company that operated successfully for over 40 years under one family. The founder, proud and independent, assumed his eldest son would naturally take over. No formal training was arranged, no ownership transfer planned, and no legal documents drafted. When the founder passed suddenly, the son was thrust into leadership with no board support, unclear authority, and immediate pressure from lenders and employees. Within 18 months, profitability dropped by 35 percent. Disputes arose among siblings who felt excluded. The business eventually had to be sold under duress at a fraction of its potential value. This wasn’t fate—it was preventable.

Such stories are not rare. According to a 2023 study by the Family Business Institute, only about 30 percent of family businesses survive into the second generation, and just 12 percent make it to the third. The primary cause? Lack of succession planning. Many owners delay the conversation, believing it’s too early or too uncomfortable. But silence isn’t neutrality—it’s a decision. And that decision often leads to rushed legal arrangements, higher tax bills, and fractured family relationships. The cost isn’t just financial; it’s emotional and generational.

One of the most damaging assumptions is that bloodline guarantees competence. Just because someone is a family member doesn’t mean they’re ready to lead. Without structured onboarding, the successor may make decisions based on loyalty rather than strategy, leading to inefficiencies and misaligned goals. Meanwhile, other family members may feel overlooked or resentful, especially if they’re not involved in the business but expect fair treatment. These tensions can escalate into legal battles, which are not only expensive but can tarnish the company’s reputation and distract from operations.

Another silent cost is tax exposure. When no plan exists, ownership transfer often happens in a lump sum—after death or sudden retirement. This triggers estate taxes, gift taxes, or capital gains in ways that could have been minimized with foresight. For example, transferring shares all at once may push the recipient into a higher tax bracket or trigger valuation discounts that reduce the business’s perceived worth. These aren’t minor details—they can cost hundreds of thousands, even millions, depending on the size of the business.

The solution begins with acknowledgment: succession is not an event, it’s a process. And like any process, it requires preparation, communication, and time. The earlier the conversation starts, the more options are available. Families that begin planning 5 to 10 years in advance give themselves room to test roles, adjust structures, and educate the next generation. They also reduce the emotional weight of the transition by normalizing it as part of the business lifecycle, not a crisis to be managed at the last minute.

Mapping the Journey: Setting a Clear Succession Timeline That Saves Money

Timing isn’t everything—it’s the only thing. Starting the succession process too late leads to rushed decisions, while starting too early can cause power struggles. A well-paced plan, however, reduces stress and financial leakage. This section breaks down how to create a realistic, phased timeline that aligns business goals with personal readiness. From grooming the next leader to adjusting operations, each phase can be optimized to lower tax exposure and avoid emergency restructuring. We’ll examine how gradual transitions smooth leadership change and keep costs under control.

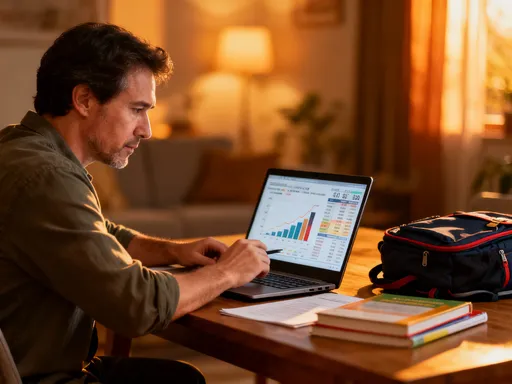

A successful succession timeline typically spans 5 to 10 years and includes distinct phases: preparation, transition, and handover. The preparation phase begins with self-assessment. The current owner evaluates their own readiness to step back, the business’s stability, and the potential successor’s capabilities. This is also the time to engage advisors—legal, tax, and financial—to assess the current structure and identify risks. For example, is the business held in a sole proprietorship, partnership, or corporation? Each has different implications for transfer and taxation. Addressing these early allows for smooth structural changes without urgency.

The transition phase is where the real work happens. Over 3 to 5 years, the successor gradually takes on more responsibility. This might start with shadowing the owner, then managing a department, then overseeing P&L for a division. These incremental steps build competence and confidence while allowing the current leader to mentor and correct course. Crucially, this phase also includes legal and financial adjustments. Shares can be transferred in small increments, staying under annual gift tax exclusions—$17,000 per recipient in 2023. This strategy, known as gifting within exemption limits, allows ownership to shift tax-free over time.

During this period, the business can also restructure for efficiency. For instance, moving from a C-corporation to an S-corporation or LLC may reduce double taxation and simplify profit distribution. These changes are far easier to implement when there’s no immediate pressure. A rushed transition often forces families to accept the status quo, even if it’s suboptimal. But with time, they can optimize operations, update technology, and align management practices with modern standards—all of which increase valuation and reduce future costs.

The final handover phase should feel like a natural conclusion, not a sudden shift. By this point, the successor has proven their ability, the team has adjusted, and the legal framework is in place. The current owner may remain in an advisory role, offering guidance without controlling decisions. This soft exit preserves relationships and ensures continuity. Importantly, a phased timeline also allows for flexibility. If the successor encounters challenges, the timeline can be extended. If the business grows faster than expected, the process can accelerate. The key is having a plan that’s structured but not rigid.

One family-owned food distribution company implemented a 7-year timeline. The father began by having his daughter, the designated successor, work in customer service and logistics—areas outside her comfort zone. Over time, she moved into operations, then finance, and eventually led strategic planning. Each step was supported by external training and mentorship. The ownership transfer occurred in five annual installments, each under the gift tax limit. By the time the father retired, the business was more profitable than ever, and the transition was seamless. No consultants were needed, no disputes arose, and tax liability was minimal. This wasn’t luck—it was timing.

Tax Traps and How to Dodge Them: Smart Structures for Lower Bills

Taxes don’t have to be the biggest expense in succession. Yet many families overpay due to outdated structures or poor entity choices. This section unpacks common tax pitfalls—like unprepared gift taxes, capital gains shocks, or estate inclusion—and shows how modern planning tools can help. Trusts, buy-sell agreements, and gradual share transfers aren’t just for billionaires. When used wisely, they reduce tax burdens and protect business value. We’ll explain these strategies in plain terms, focusing on real benefits without hype.

One of the most common tax traps is the sudden transfer of business ownership upon death. Without prior planning, the entire value of the business may be included in the estate, triggering federal estate taxes if the total estate exceeds the exemption limit—$12.92 million per individual in 2023. Even if the family doesn’t owe estate tax, the lack of liquidity can force a sale. Many small businesses are asset-rich but cash-poor. When heirs inherit the business, they may need to sell part of it—or the whole thing—to cover taxes and other expenses. This is especially painful when the business has deep emotional and community value.

Another trap is the capital gains tax that can arise when shares are sold or revalued. If the business has appreciated significantly since its founding, a lump-sum transfer could create a large taxable event. For example, if the original cost basis was $100,000 and the current value is $5 million, the difference could be subject to capital gains tax when ownership changes hands. This can erode the net value the successor receives, making it harder to invest in growth or manage debt.

To avoid these pitfalls, families can use several proven strategies. One is the installment sale, where the current owner sells shares to the successor over time. Payments are made annually, and only the gain on each payment is taxed. This spreads the tax burden and provides cash flow to the seller. It also allows the buyer to fund the purchase from business earnings, reducing the need for external loans.

Another powerful tool is the grantor retained annuity trust (GRAT). In this structure, the owner transfers shares into a trust but retains the right to receive fixed payments for a set period. If the business grows during that time, the appreciation passes to the successor tax-free. GRATs are particularly effective when interest rates are low and business value is expected to rise. They require careful setup and legal oversight, but the tax savings can be substantial.

Buy-sell agreements are another essential component. These legally binding contracts outline how ownership will transfer in the event of death, disability, or retirement. Funded with life insurance, they ensure there’s cash available to buy out a departing owner’s shares without disrupting operations. For example, if a co-owner passes away, the policy pays the estate, and the business continues under the surviving owners. This prevents forced sales and maintains stability.

Finally, gifting shares gradually—within annual exclusion limits—can transfer ownership without triggering gift tax. Over 10 years, an owner can gift up to $170,000 per recipient tax-free (assuming the 2023 limit). For a business worth millions, this can shift significant control while minimizing tax exposure. When combined with valuation discounts—for lack of marketability or minority interest—families can transfer even more value at lower reported values.

Leadership Handoff: Training the Next Gen Without Wasting Resources

Passing the business isn’t just about ownership—it’s about capability. Many successors inherit control but lack real-world experience, leading to costly missteps. This section emphasizes structured training, mentorship, and trial runs in key roles. By investing time instead of cash, families avoid expensive consultant fixes later. We’ll explore how shadowing, profit-and-loss accountability, and external work experience build confidence and competence—without bleeding the company dry.

Capability cannot be inherited—it must be developed. A common mistake is assuming that growing up in the business equates to readiness. While familiarity is valuable, it’s not a substitute for formal training and diverse experience. A successor who has only seen one side of the operation may lack the strategic vision or operational discipline needed to lead. Without proper preparation, they may rely on outdated practices, resist innovation, or mismanage teams.

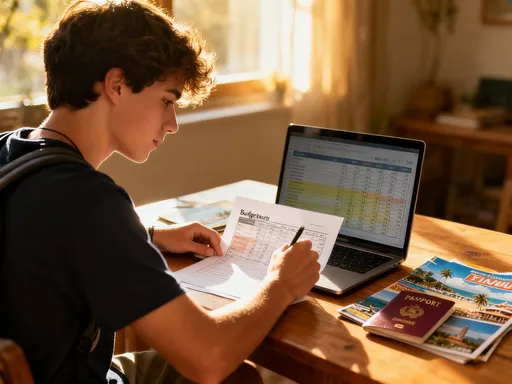

Structured training begins with exposure. The successor should rotate through key departments—sales, operations, finance, customer service—not just to learn processes, but to understand how each contributes to profitability. This cross-functional experience builds a holistic view of the business. It also helps identify strengths and gaps. For example, someone strong in customer relations but weak in financial analysis may need targeted coaching in budgeting and forecasting.

Mentorship is equally important. The current owner should serve as a guide, not a micromanager. Regular check-ins, goal setting, and feedback sessions create a culture of growth. The owner can share lessons from past mistakes, explain strategic decisions, and model leadership behavior. This isn’t about passing down habits—it’s about transferring wisdom.

External work experience is another powerful tool. Requiring the successor to work outside the family business for 2 to 3 years exposes them to different management styles, technologies, and markets. It builds credibility with employees who might otherwise see them as entitled. It also fosters humility and adaptability—qualities essential for long-term leadership.

Profit-and-loss accountability is a critical step. Before full leadership, the successor should manage a division or project with real financial responsibility. This could mean overseeing a new product launch, a regional expansion, or a cost-reduction initiative. Success or failure provides tangible feedback. If they deliver results, confidence grows. If they struggle, there’s time to adjust—before the entire business is at stake.

One family in the construction industry required their son to work for a national contractor before returning. He learned modern project management systems, safety protocols, and client negotiation techniques. When he rejoined the family firm, he implemented digital scheduling and reporting tools that reduced delays by 22 percent. The investment in his development paid for itself in less than two years. No consultants were hired, no costly errors made. The transition was smooth because preparation came first.

Fairness vs. Equality: Balancing Family Dynamics to Avoid Costly Conflicts

Treating all children equally doesn’t always mean giving them the same. Forcing equal ownership on an active successor and a disinterested sibling can spark legal battles and emotional strain. This section dives into strategies for fair but not identical distribution—using life insurance, non-business assets, or phased buyouts. By addressing emotional and financial equity early, families prevent disputes that drain time, money, and morale.

Family harmony is often the hidden casualty of succession. When multiple siblings are involved, the question of fairness becomes central. Some parents feel obligated to divide ownership equally, regardless of involvement. But this can create resentment. The sibling running the business may feel it’s unfair to share profits with someone who doesn’t contribute. The non-involved sibling may feel excluded from decisions or undervalued. Over time, these tensions can escalate into conflict.

Fairness isn’t the same as equality. A more balanced approach recognizes different roles and interests. The active successor receives ownership and control, while other family members receive value through alternative means. Life insurance is a common and effective tool. The owner takes out a policy on their life, with non-involved children as beneficiaries. When the owner passes, the payout provides financial security without diluting business ownership. This ensures everyone is cared for, without compromising the company’s future.

Non-business assets can also be used to balance the estate. Real estate, investment accounts, or personal property can be distributed to siblings not in the business. This allows the business to remain intact while still providing equitable inheritance. For example, one family transferred a vacation home and brokerage account to two daughters, while the son received the family manufacturing company. All children received assets of similar value, but only the son had operational responsibility.

Phased buyouts are another option. The successor gradually purchases shares from siblings over time, using business profits. This keeps the company in the family while providing liquidity to others. Buy-sell agreements can formalize these arrangements, setting clear terms for valuation and payment. This prevents disputes over price or timing.

Open communication is essential. Family meetings, facilitated by a neutral advisor, allow everyone to express expectations and concerns. These conversations should happen early, before emotions run high. When all voices are heard, the plan feels inclusive, even if outcomes differ. Transparency builds trust and reduces the risk of future litigation.

Outside Eyes, Smarter Moves: Why Advisors Pay for Themselves

Going it alone might feel cheaper, but it often costs more in the long run. A skilled team—lawyer, CPA, financial planner—can spot savings you’d miss. This section explains how the right advisors help structure deals, reduce taxes, and keep emotions in check. Their fees are an investment, not an expense. We’ll show how their input often uncovers five- or six-figure savings, making their cost negligible.

Many family business owners pride themselves on independence. They’ve built the company without outside help—why start now? But succession is different. It involves complex legal, tax, and interpersonal dynamics that even the most capable leaders can’t navigate alone. Advisors bring objectivity, expertise, and structure. They don’t make decisions for the family—they equip them to make better ones.

A CPA with experience in small business taxation can identify deductions, credits, and structuring opportunities that reduce tax liability. For example, they might recommend cost segregation studies to accelerate depreciation, or advise on retirement plan contributions that lower taxable income. These strategies can save tens of thousands annually—far exceeding their fees.

An estate planning attorney ensures documents are legally sound. Wills, trusts, buy-sell agreements, and powers of attorney must be precisely drafted to reflect intentions and comply with state laws. A single error can invalidate a plan or trigger unintended consequences. Legal counsel also helps navigate family dynamics, offering neutral language that reduces ambiguity and conflict.

A financial planner coordinates the big picture. They align business succession with personal goals—retirement, education funding, legacy planning. They model different scenarios, showing how choices today affect outcomes tomorrow. This clarity helps families avoid emotional decisions and stay focused on long-term success.

One family spent $28,000 on a comprehensive succession plan involving three advisors. Within two years, they saved over $150,000 in taxes and avoided a $200,000 penalty due to a corrected valuation error. The advisors didn’t just pay for themselves—they generated a net gain. More importantly, they provided peace of mind. The family felt confident their plan was solid, legal, and fair.

The Final Step: Testing the Plan Before It’s Too Late

No plan survives first contact—unless you test it. This section stresses the importance of dry runs: temporary leadership shifts, simulated ownership transfers, or trial trust setups. These rehearsals reveal flaws early, allowing fixes before real stakes kick in. By stress-testing the process, families gain confidence and avoid last-minute scrambles that inflate costs. Succession isn’t a single event—it’s a process worth preparing for, every step of the way.

Even the best-laid plans can fail if they’re never tested. A dry run simulates key aspects of the transition without permanent consequences. For example, the successor might serve as interim CEO for six months while the owner takes a sabbatical. During this time, the team adjusts, systems are evaluated, and leadership style is observed. If challenges arise, they can be addressed while there’s still time.

Simulated ownership transfers test legal and tax structures. A small percentage of shares can be formally transferred to a trust or successor, triggering the paperwork and reporting requirements. This reveals any gaps in documentation or misunderstandings about process. It also gives the successor experience in managing ownership responsibilities, such as tax filings or board meetings.

Family meetings can also be rehearsed. Presenting the plan to all stakeholders allows for feedback and clarification. If a sibling expresses surprise or concern, it’s better to hear it now than after the owner is gone. These discussions build alignment and reduce the risk of future disputes.

One restaurant group conducted a full transition rehearsal. The father stepped back for three months, handing daily operations to his daughter. She managed staffing, vendor contracts, and financial reporting. The family held a meeting to review performance, and advisors evaluated the legal setup. Minor issues were found—a missing power of attorney, unclear profit distribution rules—and corrected. When the real transition happened two years later, it went smoothly because they had already practiced.

Testing isn’t a sign of doubt—it’s a sign of wisdom. It shows commitment to getting it right. Families that rehearse their succession plan don’t eliminate risk, but they reduce uncertainty. They enter the final phase with confidence, knowing they’ve done everything possible to protect the business, the family, and the future.