How I Turned My Weekend Fun Into Smart Returns

What if your Friday night out could actually make you money? Sounds wild, right? I used to see entertainment spending as pure loss—until I realized how small shifts in mindset and choices can turn leisure into leverage. This isn’t about cutting back on fun; it’s about upgrading how you enjoy it. I tested strategies across concerts, dining, travel, and streaming, and what I found changed my financial habits forever. What began as curiosity became a structured approach to treating entertainment not as an expense, but as an opportunity. By aligning enjoyment with value, I discovered that fun doesn’t have to drain your wallet—it can actually strengthen it. The key lies in intentionality, awareness, and the quiet power of compounding small advantages over time.

The Hidden Cost of Fun (And Why It Matters)

Entertainment spending often feels harmless—grabbing coffee, hitting up a concert, or subscribing to yet another streaming service. But these small joys add up fast. Most people don’t realize how much they bleed cash on activities meant to relieve stress. The average American household spends over $3,000 annually on entertainment, according to data from the U.S. Bureau of Labor Statistics. That’s more than many families allocate to emergency savings or retirement contributions in the same period. The real issue isn’t spending—it’s spending blindly. When you treat entertainment as an expense with zero return, you miss opportunities to align enjoyment with value. Understanding this gap is the first step toward smarter consumption.

Consider this: a monthly concert habit at $75 per event totals $900 a year. Add dinner, parking, and drinks, and the figure climbs well past $1,200. That’s not insignificant—but what if part of that spending could be recaptured? What if those dollars earned points, unlocked access, or reduced future costs? Most consumers view such expenses as sunk costs, accepting them as the price of relaxation. But this mindset ignores a fundamental truth—every dollar spent is a decision point. It can either vanish or serve a dual purpose. The shift begins with recognizing that entertainment is not inherently wasteful. Waste happens when spending lacks awareness and strategy.

For many, the emotional payoff of fun justifies the cost. That’s valid. No one should live without joy. But emotional relief doesn’t require financial loss. The goal isn’t to eliminate leisure—it’s to make it work harder. This requires moving from passive consumption to active engagement. Instead of asking, “Can I afford this?” we should ask, “What does this give me beyond the moment?” When you start measuring entertainment by its long-term benefits, not just its immediate pleasure, you begin to see opportunities where others see only expenses.

From Passive Spending to Active Value Building

What if your entertainment choices could generate long-term benefits? This shift starts with redefining “return.” It’s not just cash back—it’s points, access, data, experiences that compound. I started tracking not just how much I spent, but what I gained. A concert ticket became part of a loyalty program; a dinner out unlocked exclusive event invites. The goal? Turn every dollar spent into a dual-purpose tool—enjoyment today, value tomorrow. This isn’t about squeezing every cent from fun. It’s about designing a system where fun contributes to financial resilience.

Take credit card rewards, for example. Many cards offer 3% to 5% back on dining and entertainment. If you’re already going out, using the right card means you’re effectively lowering the cost of each experience. Over a year, that 5% on $2,000 in spending returns $100—enough to cover two nice dinners or a concert ticket. But most people don’t optimize this simple step. They use default cards with flat 1% rewards or pay cash, missing out on free money. The key is alignment: match your spending habits with reward structures. If you dine out frequently, choose a card that rewards restaurants. If you stream often, pick one that gives extra points on digital subscriptions.

Beyond cashback, there are experiential returns. Some credit cards offer access to presale tickets, VIP lounges, or exclusive events. These aren’t just perks—they’re forms of value that money can’t easily buy. Attending a sold-out concert because your card gave early access is a return that transcends dollars. Similarly, joining brand-specific programs—like a theater chain’s membership or a music festival’s fan club—can yield discounts, free upgrades, or referral bonuses. These benefits accumulate quietly, reducing future costs without requiring lifestyle changes.

The mindset shift is critical: stop seeing entertainment as a one-way transaction. Instead, treat it as an investment in both well-being and financial strategy. This doesn’t mean calculating ROI on every coffee. It means building habits that consistently tilt the balance toward value. Over time, small advantages compound. What feels like normal spending becomes a source of quiet financial growth.

The Upgrade Mindset: Spending Smarter, Not Less

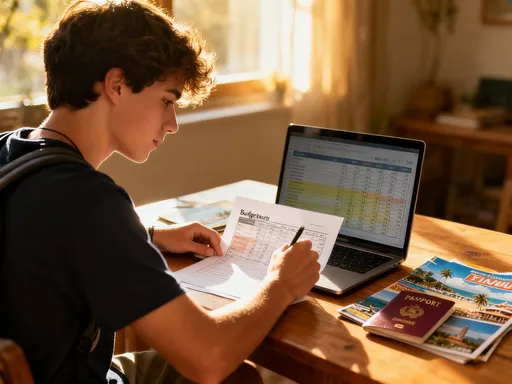

Consumption upgrade isn’t about luxury—it’s about leverage. Instead of skipping movie nights, I upgraded how I watched films: group screenings with friends using shared subscriptions, or attending premieres that offered early access and referral perks. The key was focusing on experiences that offered both immediate joy and secondary benefits. This section dives into real scenarios where slight changes in behavior created measurable financial upside.

One powerful example is the shift from individual to shared streaming accounts. A single premium subscription can cost $15 to $20 per month. But when split among three or four trusted friends, the cost drops to $4 or $5—less than a latte. Platforms like Netflix, Hulu, and Disney+ allow multiple profiles and simultaneous streams, making sharing seamless. The savings are immediate, but the benefits go further. Shared accounts often come with informal agreements—like rotating who picks the movie or hosts viewing parties. These small rituals deepen social bonds while reinforcing mindful spending.

Another upgrade is timing. Many entertainment venues offer discounted rates on off-peak days. Matinee movie showings, weekday museum hours, or early-bird dining specials can cut costs by 20% to 40%. By shifting routines slightly—choosing a Saturday afternoon concert instead of Saturday night—you avoid crowds and save money. These changes don’t reduce enjoyment; they enhance it by reducing stress and cost. Over a year, such timing adjustments can save hundreds without requiring sacrifice.

Then there’s the power of bundling. Instead of buying tickets individually, look for package deals. Many cities offer entertainment passes that bundle access to multiple attractions at a discount. The Go City Pass, for instance, provides entry to dozens of museums, tours, and activities at a fraction of the total a la carte price. Even local restaurants sometimes offer “experience bundles”—a meal plus a show or workshop at a reduced rate. These deals turn isolated expenses into coordinated value. The key is planning ahead and researching options, which takes minimal effort but yields significant returns.

Maximizing Returns Through Loyalty and Access Programs

Brands want your attention—and they’ll reward you for it. I tested multiple loyalty programs tied to entertainment venues, from theaters to music festivals. Some gave early-bird access; others offered cash-equivalent points. The trick? Not joining every program, but strategically selecting ones that matched my existing habits. Over time, these rewards offset future spending or unlocked premium experiences—without extra cost.

Take AMC Stubs, for example. For a small annual fee, members earn points on every ticket and concession purchase. Those points can be redeemed for free popcorn, discounted tickets, or even IMAX upgrades. Over a year of regular moviegoing, I accumulated enough points to cover two full tickets and several snacks. The program didn’t require spending more—it simply rewarded spending I was already doing. Similarly, Live Nation’s fan club offers presales, exclusive merchandise, and VIP seating for frequent concertgoers. By joining, I secured tickets to a sold-out show at face value, avoiding scalper markups that can double the price.

The real power of loyalty programs lies in consistency. One-off memberships rarely pay off. But when you align them with routines—like weekly coffee runs, monthly dinners, or seasonal concerts—they begin to generate real value. The key is tracking benefits and canceling programs that don’t deliver. Not all loyalty schemes are equal. Some have hidden fees, low redemption value, or complex rules. A good rule of thumb: if the annual cost exceeds the likely benefits, skip it. Focus on programs with simple earning structures and tangible rewards.

Another often-overlooked benefit is data. Loyalty programs track your behavior, and some share insights back. You might receive personalized offers, birthday rewards, or notifications about events you’re likely to enjoy. This isn’t just marketing—it’s a form of financial intelligence. By understanding your own patterns, you can make better decisions. For instance, seeing that you spend $60 a month on coffee might prompt you to switch to a rewards-based café or negotiate a workplace perk. The program becomes a mirror, reflecting your habits and highlighting opportunities.

Bundling, Sharing, and the Power of Smart Collaboration

Going solo is easy—but sharing smartly multiplies value. I experimented with cost-splitting models among trusted friends: shared premium accounts, group bookings for events, even rotating hosting for game nights. The savings weren’t just financial; we built stronger routines around mindful spending. This section explores how collaboration turns individual costs into collective gains—without friction.

One of the most effective strategies was the “entertainment pod”—a small group of four friends who agreed to share subscriptions and split event costs. We rotated who hosted monthly movie nights, each person taking a turn to provide snacks and space. For concerts, we booked group tickets, which often came with discounts. Some venues offer 10% to 15% off for parties of six or more. Over a year, these small savings added up to over $300 in reduced spending. More importantly, the pod created accountability. Knowing others were tracking the value made us more intentional about choices.

Sharing also reduces decision fatigue. Instead of endlessly scrolling through streaming options alone, we curated a monthly watchlist together. This not only saved time but increased satisfaction—watching something chosen collectively feels more meaningful. Similarly, dining out as a group allows for splitting appetizers, desserts, or bottles of wine, which would be impractical solo. The experience becomes richer, not just cheaper.

Of course, collaboration requires trust and clear boundaries. We established simple rules: no last-minute cancellations, equal contribution, and open communication about budgets. These norms prevented resentment and kept the system running smoothly. The lesson? Shared spending works best when it’s structured, not spontaneous. A little planning turns potential conflict into lasting benefit.

Tracking and Measuring What Truly Counts

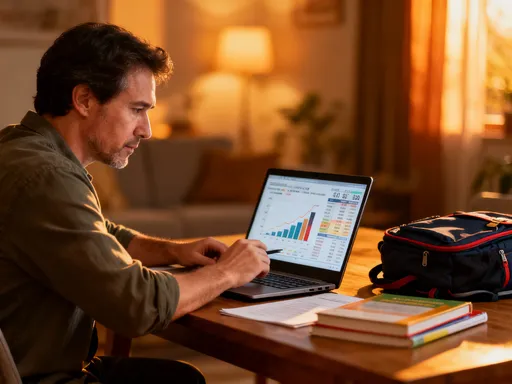

You can’t optimize what you don’t measure. I built a simple tracking system to monitor not just spending, but returns: discounts used, points earned, free access gained. Over months, patterns emerged—certain venues consistently delivered higher value, while others were emotional traps disguised as fun. This data-driven approach helped me cut noise and double down on high-return entertainment.

I started with a spreadsheet, logging every entertainment expense and its associated benefit. Column A: date and activity. Column B: amount spent. Column C: rewards earned (points, discounts, free items). Column D: non-financial value (e.g., social connection, stress relief). After six months, I reviewed the data. Some findings were surprising. A popular brunch spot with no rewards program cost $48 per visit but offered zero long-term value. In contrast, a local theater with a loyalty card cost $35 per ticket but returned $8 in concessions and early access. The cheaper option wasn’t always the better deal.

The tracking also revealed emotional spending spikes—times when I went out to cope with stress, not genuine desire. These instances had high costs and low satisfaction. Recognizing this pattern allowed me to replace impulsive outings with lower-cost alternatives, like walks with friends or home game nights. The spreadsheet didn’t judge—it simply showed the truth. And in that clarity, I found power.

Over time, I refined my approach. I categorized entertainment into three tiers: high-return (offers rewards and joy), medium-return (pleasant but neutral), and low-return (costly with little benefit). I shifted spending toward the first tier and limited the third. This wasn’t about deprivation—it was about alignment. The result? I spent roughly the same amount annually, but the quality and value of my experiences improved significantly.

Balancing Risk, Reward, and Realistic Expectations

No strategy works without awareness of risk. Chasing returns can lead to overcommitting or spending just to earn rewards—defeating the purpose. I learned to set boundaries: never spend more than I would naturally, and always prioritize real enjoyment over artificial gains. True return maximization means staying in control, not falling into a new kind of trap.

One common pitfall is the “reward spiral”—buying things you don’t need just to earn points. For example, signing up for five credit cards to get sign-up bonuses might seem smart, but it can hurt your credit score and lead to overspending. The key is moderation. Stick to one or two cards that align with your lifestyle. Similarly, joining too many loyalty programs can become a chore. If managing accounts takes more time than the benefits are worth, it’s not worth it. Simplicity is strength.

Another risk is emotional fatigue. Constantly tracking and optimizing can drain the joy out of fun. The goal isn’t to turn leisure into a job. It’s to make it more sustainable. I set rules: no tracking on vacation, no discussing budgets during outings, and one “guilt-free” splurge per quarter. These boundaries preserved spontaneity and pleasure. Finance should serve life, not dominate it.

Realistic expectations are crucial. You won’t get rich from loyalty points. But you can consistently reduce costs, gain access, and make your money work harder. The returns are modest but reliable—like a 5% to 10% reduction in annual entertainment spending. Over time, that’s hundreds of dollars saved, which can be redirected to goals like family vacations, home improvements, or retirement. The power lies in consistency, not magnitude.

Where Fun Meets Financial Sense

Entertainment doesn’t have to be a budget leak—it can be a strategic asset. By shifting perspective, leveraging tools, and staying disciplined, I transformed my leisure spending into a source of hidden returns. It’s not about sacrificing joy; it’s about amplifying it with intelligence. The future of personal finance isn’t just saving and investing—it’s consuming with purpose.

This approach isn’t about perfection. It’s about progress. Start small: pick one habit—coffee, movies, dining—and apply one strategy—rewards cards, sharing, or timing. Track the results. Adjust as needed. Over time, these micro-changes build a resilient financial foundation. You’ll still enjoy Friday nights, but now they’ll be working for you, not against you.

Fun and finance don’t have to be enemies. When aligned with intention, they become allies. Every dollar spent is a vote for the kind of life you want. Make each one count—not by spending less, but by getting more. That’s the quiet revolution of smart consumption. And it starts not with sacrifice, but with awareness.