How I Slashed My Critical Illness Coverage Costs Without Sacrificing Protection

I used to think comprehensive critical illness insurance was too expensive—until I discovered smarter ways to cut costs without risking coverage. After nearly overpaying for years, I tested different strategies, from policy tweaks to lifestyle adjustments. What I learned changed everything. Here’s how I reduced my premiums significantly while staying fully protected, and how you can too—without falling into common traps. It wasn’t about choosing the cheapest plan or skipping essential protections. It was about understanding what truly matters in a policy, aligning it with real risks, and making informed decisions that saved hundreds each year. This journey began with a simple question: Am I paying for security, or just the feeling of it?

The Hidden Cost of Feeling "Safe"

Many people believe that high premiums are the unavoidable cost of being well-protected. This assumption, however, is rooted more in emotion than in financial logic. The desire to feel safe can lead to over-insuring, where individuals pay for coverage they are extremely unlikely to use. Insurance companies often market policies using fear-based narratives—highlighting rare but dramatic illnesses like Ebola or Creutzfeldt-Jakob disease, which, while terrifying, have negligible statistical likelihood. The reality is that the most common critical illnesses driving claims are heart attacks, strokes, and certain cancers—not the exotic or sensational conditions that dominate promotional materials.

According to data from major health insurers, over 80% of critical illness claims stem from just five conditions: heart attack, stroke, coronary artery bypass surgery, cancer, and kidney failure. Yet many policies include dozens of additional conditions, some with occurrence rates so low they may never trigger a payout in a policyholder’s lifetime. These inclusions inflate premiums without adding meaningful value. A policy that covers 50 illnesses may cost 30% more than one covering 25, even though the additional coverage applies to conditions with less than a 0.1% chance of diagnosis. This gap between perceived and actual risk is where most people overspend.

The emotional comfort of “being covered for everything” comes at a steep financial price. When individuals buy policies based on fear rather than facts, they often duplicate protections they already have. For example, someone with a robust health insurance plan and a strong emergency fund may not need a critical illness policy that pays out for minor cancer treatments. Yet they purchase it anyway, thinking, “What if?” That “what if” mentality, while understandable, is precisely what drives up costs. Recognizing this psychological trap is the first step toward smarter spending. True financial security comes not from insuring against every imaginable scenario, but from focusing on the most probable and impactful risks.

Moreover, the structure of critical illness insurance often encourages over-purchasing. Policies are frequently sold in bundles, with additional riders and add-ons presented as essential upgrades. A “wellness rider” that pays a small bonus for annual check-ups or a “family care benefit” that provides limited support for caregivers may sound appealing, but they add cost without substantial return. These features are designed to increase the perceived value of the policy, not necessarily its practical utility. By evaluating each component based on actual need and statistical likelihood, consumers can avoid paying for features that offer more psychological reassurance than financial benefit.

Rethinking What “Full Coverage” Really Means

The term “full coverage” is often misunderstood. Many assume it means a policy that includes every possible illness, but in reality, it should mean adequate protection for the risks that matter most. A smarter approach is to define “full” not by quantity of covered conditions, but by relevance and likelihood. This shift in perspective allows for more efficient spending without compromising security. For instance, a policy that covers stage 1 breast cancer may seem comprehensive, but early-stage diagnoses often require less financial disruption than advanced cases. The real financial burden comes with treatments like chemotherapy, surgery, and long-term recovery—situations where income replacement and lump-sum support are most needed.

When reviewing a critical illness policy, it’s essential to distinguish between high-probability and low-probability conditions. Heart disease, for example, affects one in four adults and is a leading cause of critical illness claims. Cancer diagnoses are similarly common, with one in three people expected to receive a cancer diagnosis in their lifetime. In contrast, conditions like ALS or organ transplant rejection are far less frequent. Including them in a policy may provide peace of mind, but it also increases the premium for a benefit that may never be used. A more strategic approach is to prioritize coverage for the conditions most likely to impact financial stability.

Another key consideration is the definition of “critical illness” within the policy. Some insurers use narrow definitions that exclude certain stages or types of illness, while others have broader criteria. A policy that covers “any cancer except basal cell” is more valuable than one that only pays out for advanced stages. However, broader definitions often come with higher costs. The goal is to find a balance—a policy that covers significant diagnoses without extending to trivial or improbable cases. For example, covering early-stage prostate cancer may not be necessary if treatment is typically outpatient and does not require extended time off work.

Customizing a policy to fit personal and family health history can also lead to substantial savings. Someone with a family history of heart disease should prioritize cardiac coverage, while another with a history of cancer may focus on oncology-related benefits. This tailored approach ensures that protection aligns with actual risk, rather than generic assumptions. By auditing their policy for redundant or irrelevant benefits, consumers can often eliminate 10–20% of the cost without reducing meaningful protection. The result is a leaner, more focused plan that delivers the same level of security at a lower price.

Smart Policy Design: The Structure That Saves Thousands

The structure of a critical illness policy has a profound impact on its cost. While most people focus on the list of covered conditions, the real savings lie in the fine print: waiting periods, survival periods, payout terms, and exclusions. These elements are often overlooked, yet they can reduce premiums by thousands of dollars over the life of the policy. For example, most policies require a “survival period”—typically 14 to 30 days—during which the insured must survive after diagnosis to receive the payout. Extending this period from 14 to 30 days can lower premiums by 10–15%, with minimal risk, since most critical illnesses either resolve quickly or progress over a longer timeline.

Similarly, adjusting the waiting period before coverage begins can lead to significant savings. A policy with a 90-day waiting period instead of immediate coverage may cost 20% less. For many, this trade-off makes sense: if they have an emergency fund to cover the first three months of illness, the lower premium provides long-term value. The key is aligning the policy structure with existing financial safeguards. Those with substantial savings can afford longer waiting periods, while those with fewer resources may prefer immediate coverage.

Payout structure is another area where smart design pays off. Some policies offer a single lump sum, while others provide staged payments based on treatment milestones. A lump-sum payout is generally more valuable, but it also costs more. A hybrid model—where a portion is paid upfront and the rest upon surgery or hospitalization—can reduce costs while still providing timely support. Additionally, policies that exclude certain high-cost but low-frequency treatments (like experimental therapies) can be more affordable without sacrificing core protection.

Exclusions are often viewed negatively, but they can be a tool for cost control when used wisely. For instance, excluding coverage for pre-existing conditions that are already managed (like controlled hypertension) may not significantly increase risk but can lower premiums. The same applies to geographic exclusions—some policies charge more for coverage that includes treatment abroad. If the policyholder plans to receive care domestically, removing international benefits can reduce costs. These structural choices, when understood and negotiated, allow consumers to tailor their policies for maximum efficiency.

Lifestyle Levers That Lower Your Risk Profile

One of the most powerful ways to reduce critical illness insurance costs is by improving your health. Insurers use medical underwriting to assess risk, and even modest improvements in health can shift someone from a high-risk to a standard-risk category, resulting in lower premiums. This isn’t about achieving perfect health; it’s about demonstrating responsible health management. Simple, sustainable habits—like maintaining a healthy weight, avoiding tobacco, managing blood pressure, and getting regular check-ups—can have a measurable impact on insurance costs.

For example, quitting smoking can reduce premiums by 15–25%. Insurers typically classify smokers as higher risk due to the increased likelihood of heart disease, stroke, and cancer. After 12 months of being smoke-free, many insurers reclassify individuals as non-smokers, leading to immediate savings. Similarly, controlling high blood pressure through diet, exercise, and medication can move someone out of a “high-risk” category. One study found that individuals with well-managed hypertension paid up to 20% less in premiums than those with uncontrolled readings.

Sleep and stress management also play a role. Chronic sleep deprivation and high stress levels are linked to increased inflammation and cardiovascular risk, factors insurers consider during underwriting. While these aren’t directly measured like cholesterol or BMI, they influence overall health markers. A person who reports consistent sleep, low stress, and regular physical activity is more likely to receive favorable underwriting terms. Even small changes, like walking 30 minutes a day or practicing mindfulness, can improve health metrics over time.

The timing of a policy application is crucial. Applying for coverage when health is optimal locks in lower rates for the long term. A 45-year-old who improves their fitness and applies after lowering their BMI may secure a rate that remains fixed for decades. In contrast, waiting until health declines can result in higher premiums or even denial of coverage. Therefore, proactive health management isn’t just good for the body—it’s a financial strategy. Prevention pays, literally, by reducing both medical risk and insurance cost.

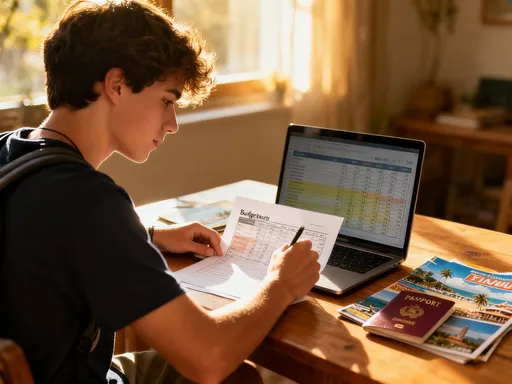

Timing and Market Moves: When to Buy, When to Wait

Not all moments are equally favorable for purchasing critical illness insurance. Age, health status, and market conditions all influence the cost and availability of coverage. The most advantageous time to buy is typically in mid-life—between ages 35 and 50—when health is generally stable, and the risk of immediate claims is low. Premiums increase with age, so securing coverage earlier locks in lower rates. A 40-year-old in good health may pay 30–40% less than someone who waits until 55, even with identical coverage.

Health changes also affect timing. A diagnosis of diabetes, high cholesterol, or early-stage heart disease can lead to higher premiums or exclusions. Therefore, it’s wise to apply for coverage before known health issues arise or worsen. Some people delay purchasing insurance, thinking they’ll “wait and see,” but this approach carries financial risk. A single health setback can make coverage significantly more expensive or even unattainable. Applying during periods of good health is one of the most effective ways to secure affordable, comprehensive protection.

Market conditions also play a role. Insurance companies periodically adjust their pricing models, introduce promotional rates, or offer discounts for bundling policies. Monitoring these shifts can help consumers time their purchase for maximum value. For example, some insurers offer lower rates during annual enrollment periods or as part of wellness initiatives. While it’s unwise to rush into a decision based on a short-term deal, being aware of market trends allows for strategic timing. The goal is to treat insurance as a financial product—one that benefits from thoughtful timing, just like a mortgage or investment.

That said, waiting too long for the “perfect” deal can be costly. Inflation, aging, and health changes erode the window of opportunity. A balanced approach is best: evaluate options regularly, apply when health is strong, and choose a policy that offers long-term value. The ideal time to buy is not when fear strikes, but when clarity and preparation meet.

Beyond the Policy: Layered Protection That Costs Less

Relying solely on insurance for critical illness protection is neither the most efficient nor the most resilient strategy. A smarter approach combines insurance with other financial tools to create a layered defense. This reduces dependency on large payouts and allows for a more affordable policy. Emergency funds, health savings accounts (HSAs), and preventive care networks are all powerful complements to insurance.

An emergency fund of six to twelve months’ worth of expenses can cover the initial costs of illness, such as deductibles, co-pays, and lost income during short-term recovery. This reduces the need for a high-payout policy, allowing individuals to choose a leaner, less expensive plan. HSAs, where available, offer triple tax advantages and can be used to pay for qualified medical expenses. Funds in an HSA can grow over time and be withdrawn tax-free for medical needs, making them an ideal tool for managing illness-related costs.

Preventive care is another critical layer. Regular screenings, vaccinations, and early interventions can prevent minor conditions from becoming critical illnesses. Many insurers offer discounted or free preventive services, and some even reward policyholders for completing wellness programs. By prioritizing prevention, individuals not only improve their health but also reduce the likelihood of needing a large insurance payout.

When these tools work together, they create a more flexible and cost-effective protection strategy. For example, an individual with a $10,000 emergency fund, a $5,000 HSA, and access to preventive care may only need a $50,000 critical illness policy instead of $100,000. The combined resources cover early-stage costs, while the policy focuses on catastrophic scenarios. This synergy reduces premiums without sacrificing security.

Putting It All Together: A Realistic Path to Smarter Coverage

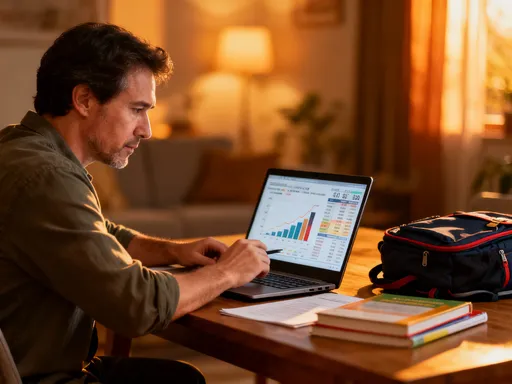

Reducing critical illness insurance costs without sacrificing protection is not about cutting corners—it’s about making informed, strategic choices. The journey begins with a clear assessment of real risks, not imagined fears. By understanding which illnesses are most likely to impact financial stability, individuals can tailor their coverage to focus on what matters. Next, policy design choices—such as adjusting waiting periods, survival periods, and payout terms—can significantly lower premiums while maintaining essential benefits.

Improving health is another powerful lever. Simple lifestyle changes, when sustained, can lead to better underwriting outcomes and lower premiums. Timing the purchase during periods of good health and favorable market conditions further enhances value. And by combining insurance with emergency savings, HSAs, and preventive care, individuals create a more resilient financial safety net.

Consider a real-world example: a 48-year-old woman with no major health issues initially paid $1,800 annually for a $100,000 critical illness policy with broad coverage. After reviewing her needs, she adjusted her policy to focus on the top five conditions, extended the survival period to 30 days, and added a 90-day waiting period. She also improved her blood pressure through diet and exercise before reapplying. The result? A new policy with equivalent core protection at $1,200 per year—a 33% reduction. She allocated the savings to her HSA and emergency fund, strengthening her overall financial health.

This story is not unique. Thousands of people overpay for insurance because they follow emotional instincts rather than financial logic. The path to smarter coverage is clear: assess real risks, optimize policy structure, improve health, and use complementary tools. It requires effort and attention, but the rewards are lasting. True financial wisdom lies in balancing protection, affordability, and peace of mind. You don’t have to pay more to be safe. You just have to be smart about how you get there.