How I Built Real Passive Income Streams — Market-Smart Moves That Actually Work

Building passive income isn’t about luck—it’s about strategy. I’ve tested multiple approaches, from dividend plays to digital assets, and learned what truly moves the needle. The market shifts constantly, but smart positioning stays effective. In this deep dive, I’ll walk you through real methods grounded in solid market analysis, showing how to generate sustainable returns while managing risk. No hype—just practical insights that protect your capital and grow your freedom. These are not get-rich-quick schemes, but time-tested financial behaviors that compound over years. Whether you're starting with $5,000 or managing a seven-figure portfolio, the principles remain the same: focus on cash flow, prioritize resilience, and let discipline guide decisions. This is how real financial independence is built—one thoughtful move at a time.

The Myth of “Set It and Forget It” Passive Income

Many people believe that passive income means setting up an investment and never touching it again. This idea is deeply embedded in popular financial culture, promoted by slogans like “buy and hold forever” or “automate your wealth.” While appealing, this mindset can be dangerously misleading. True passive income streams do require less daily involvement than active jobs, but they are far from maintenance-free. The most successful investors treat their portfolios like gardens—planted with care, then regularly monitored and pruned to ensure long-term health. Ignoring market signals or assuming stability where none exists can lead to erosion of returns or even capital loss.

Consider the example of a high-yield bond fund that promises 8% annual returns. On paper, it looks like a perfect passive vehicle. But if interest rates rise sharply, as they did in 2022 and 2023, the value of existing fixed-rate bonds drops. Investors who believed they could “set it and forget it” suddenly saw their account balances shrink, even while collecting interest. The income stream remained, but the underlying asset value eroded significantly. This illustrates a key truth: passive income is not passive risk. Every income-generating asset carries exposure to economic shifts, industry disruption, or regulatory changes. Those who ignore these forces often pay a steep price.

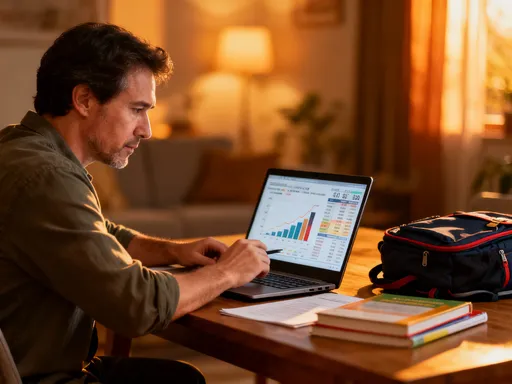

What separates successful investors is not just their initial choices, but their ongoing engagement. They review performance quarterly, reassess valuations, and rebalance when conditions change. For instance, when inflation trends accelerate, they may shift allocations toward inflation-protected securities or real assets. When technology disrupts a sector—like streaming services impacting cable TV stocks—they don’t wait for dividends to be cut; they anticipate the shift. This kind of proactive oversight doesn’t mean constant trading or emotional reactions. It means staying informed, using data-driven tools, and applying consistent evaluation criteria across all holdings.

The goal isn’t to micromanage every dollar, but to establish systems that allow for intelligent automation. Think of it as building a dashboard for your financial life—one that alerts you to anomalies, tracks yield stability, and measures diversification effectiveness. With such a system in place, you reduce emotional decision-making and increase confidence in your strategy. Passive income, then, becomes less about doing nothing and more about doing the right things at the right time, with minimal effort once the framework is built. This is the real definition of financial efficiency: structured oversight enabling long-term freedom.

Where the Market Is Heading: Signals That Matter

To build durable passive income, you must understand where the broader economy is headed. Markets don’t move randomly—they respond to structural forces like demographic shifts, technological innovation, interest rate environments, and consumer behavior. Chasing short-term trends based on headlines or social media buzz often leads to poor timing and disappointing results. Instead, focusing on long-term, measurable indicators allows investors to position themselves ahead of major shifts. These signals don’t predict the future with certainty, but they increase the odds of aligning your portfolio with enduring economic realities.

One of the most reliable macro indicators is the interest rate cycle. Interest rates influence everything from bond yields to mortgage costs to corporate borrowing. When rates are low, investors often chase yield in riskier assets, inflating prices in sectors like growth stocks or speculative real estate. But when central banks begin raising rates to control inflation, those same assets can come under pressure. Observing the trajectory of interest rates—through official policy statements, inflation data, and yield curve behavior—helps determine whether to favor income sources like short-duration bonds or dividend stocks with strong balance sheets. It also informs decisions about locking in fixed returns versus staying flexible for future opportunities.

Another critical signal is demographic change. Aging populations in developed countries are increasing demand for healthcare, retirement services, and income-producing assets. This creates long-term tailwinds for sectors like medical real estate, insurance products, and dividend-paying consumer staples. Conversely, younger, growing populations in emerging markets drive demand for digital infrastructure, education technology, and affordable housing. Investors who recognize these patterns can allocate capital to industries positioned to benefit from sustained demand rather than fleeting fads.

Technological adoption curves also offer valuable insight. The rise of cloud computing, artificial intelligence, and e-commerce has fundamentally altered how businesses operate and generate profits. Companies that leverage these technologies efficiently tend to have higher margins, better scalability, and stronger recurring revenue models—all favorable traits for passive income investors. Monitoring patent filings, R&D spending, and market penetration rates can help identify leaders before they become widely recognized. At the same time, it’s essential to watch for disruption in legacy industries. For example, traditional retail spaces have struggled as online shopping grows, impacting commercial real estate values and rental income potential.

Consumer spending habits provide another window into future income potential. During periods of economic uncertainty, people prioritize essential goods and services, benefiting sectors like utilities, food, and healthcare. In times of growth, discretionary spending rises, boosting areas like travel, entertainment, and luxury goods. Tracking retail sales data, credit card spending trends, and household savings rates helps anticipate these shifts. By aligning your income sources with resilient or growing consumer needs, you reduce exposure to sectors vulnerable to downturns or obsolescence.

Dividend Investing: Not All Payouts Are Created Equal

Dividend investing remains one of the most popular strategies for generating passive income, and for good reason. Regular payouts provide cash flow without requiring the sale of shares, allowing investors to benefit from both income and potential appreciation. However, not all dividend stocks are equally reliable. A high yield can be tempting, but it may also signal underlying problems—such as a falling stock price or unsustainable payout levels. The key to successful dividend investing lies in evaluating the quality of the company behind the dividend, not just the size of the check.

One fundamental metric I use is free cash flow coverage. A company must generate more cash than it spends to sustain dividends over time. If a firm pays out 90% or more of its earnings in dividends, it has little room to handle downturns, invest in growth, or maintain operations. I look for companies with payout ratios below 60%, indicating financial discipline and room for resilience. Even more important is free cash flow—the actual cash generated after capital expenditures. A company might report strong earnings on paper, but if it’s burning cash to maintain assets or expand, its ability to keep paying dividends is questionable.

Business durability is another critical factor. Some industries naturally lend themselves to stable, long-term profits. Consumer staples—companies that sell everyday items like food, beverages, and household goods—tend to perform consistently regardless of economic conditions. People still need toothpaste and groceries during recessions. Similarly, regulated utilities and essential services often enjoy predictable revenue streams and pricing power, making them reliable dividend payers. On the other hand, cyclical industries like energy or materials can see wild swings in profitability, leading to dividend cuts when commodity prices fall.

Competitive positioning also plays a major role. Companies with strong brands, wide economic moats, or dominant market share are better equipped to defend pricing, maintain margins, and grow over time. Consider two hypothetical firms: one is a global beverage leader with decades of consistent dividend growth, international reach, and strong brand loyalty. The other is a regional energy producer with high debt, volatile revenues, and a dividend yield that appears attractive only because the stock price has collapsed. Over time, the first company is far more likely to preserve and grow its payout, while the second may be forced to cut or eliminate dividends altogether.

Finally, dividend growth history matters. A company that has raised its dividend for 10, 20, or even 50 consecutive years demonstrates a commitment to shareholder returns and financial strength. These “dividend aristocrats” or “kings” are not immune to market downturns, but their track record suggests a culture of prudence and long-term thinking. By focusing on quality rather than yield alone, investors can build a portfolio of dividend stocks that deliver steady, growing income through various market cycles.

Real Estate Without Landlords: The Rise of Passive REIT Strategies

Real estate has long been a cornerstone of wealth-building, offering both income and appreciation. However, being a landlord comes with significant responsibilities—property maintenance, tenant management, legal compliance, and unexpected repairs. These demands make traditional rentals less “passive” than many hope. Fortunately, there’s a way to gain exposure to real estate income without the headaches: Real Estate Investment Trusts (REITs). By investing in publicly traded REITs, individuals can earn rental-like income through dividends while benefiting from professional management and diversification.

REITs are companies that own, operate, or finance income-producing properties. To qualify for favorable tax treatment, they must distribute at least 90% of their taxable income to shareholders, resulting in high dividend yields. But not all REITs are the same. Some specialize in office buildings, others in shopping malls, apartments, industrial warehouses, or healthcare facilities. Each property type responds differently to economic conditions. For example, residential REITs may hold up well during downturns due to steady housing demand, while retail REITs can struggle if consumer shopping habits shift toward e-commerce.

When evaluating REITs, I focus on several key fundamentals. First is funds from operations (FFO), a measure of cash flow specific to real estate companies. Unlike net income, FFO accounts for depreciation, which can distort profitability in property-heavy businesses. A stable or growing FFO indicates healthy operations and the ability to sustain dividends. Second is debt levels. Real estate is capital-intensive, and excessive leverage can become dangerous during interest rate hikes or occupancy declines. I prefer REITs with conservative debt-to-EBITDA ratios—typically below 6x—as they are better positioned to weather economic stress.

Occupancy rates and lease duration also matter. A REIT with 95% occupancy and long-term leases has predictable income, while one with high vacancy or month-to-month tenants faces greater uncertainty. Additionally, geographic diversification reduces regional risk. A REIT with properties across multiple states or countries is less vulnerable to local economic shocks than one concentrated in a single market. I also consider external factors like urbanization trends, remote work impacts on office demand, and supply chain growth driving industrial space usage.

Timing matters too. REIT prices can be sensitive to interest rate changes, often declining when rates rise due to increased borrowing costs and competition from bonds. However, this can create buying opportunities for long-term investors. By purchasing high-quality REITs during periods of market pessimism, you can lock in higher yields and position for capital appreciation when sentiment improves. Strategic entry points, combined with disciplined holding, make REITs a powerful tool for building passive income without becoming a landlord.

Digital Assets: When Tech Meets Recurring Revenue

In today’s economy, digital platforms have created new avenues for generating passive income. Unlike physical assets, digital ventures—such as subscription-based apps, online courses, or content monetization systems—can scale rapidly with minimal incremental cost. Once built, they can deliver recurring revenue with relatively low maintenance. However, not all digital assets are sustainable. Many fail due to poor user engagement, lack of differentiation, or changing algorithms. Success requires careful planning, execution, and ongoing optimization.

One of the most effective digital income models is the subscription service. Whether it’s a productivity app, a niche educational platform, or a curated content newsletter, recurring subscriptions create predictable cash flow. The key to longevity is user retention. A product that solves a real problem, delivers consistent value, and evolves with customer needs will retain subscribers longer. High churn rates—where users cancel quickly—can undermine profitability no matter how many new customers are acquired. Therefore, I evaluate digital ventures based on their retention metrics, customer lifetime value (LTV), and cost to acquire a customer (CAC). A healthy LTV:CAC ratio of 3:1 or higher indicates sustainability.

Scalability is another crucial factor. Digital products can serve thousands or even millions of users without proportional increases in cost. This leverage allows for high profit margins once the initial development is complete. However, scalability also attracts competition. To stand out, a digital asset must offer unique value—whether through superior design, exclusive content, or network effects. Platforms that build communities or enable user interaction often enjoy stronger loyalty and organic growth.

Monetization models vary widely. Beyond subscriptions, options include advertising, affiliate marketing, premium features, or one-time purchases. Each has trade-offs. Advertising can generate income without charging users directly, but it depends on traffic volume and ad rates, which can fluctuate. Affiliate marketing ties revenue to third-party sales, introducing dependency on external partners. Premium features allow free access while monetizing power users, balancing growth and profitability. The best approach often combines multiple streams, creating resilience against shifts in any single channel.

Market validation is essential before investing time or money. Launching a minimum viable product (MVP) allows testing demand with minimal risk. Feedback from early users helps refine the offering before full-scale development. Additionally, analyzing competitors provides insight into pricing, features, and customer pain points. A crowded market isn’t necessarily a bad sign—if there’s demand, there’s opportunity—but it demands a clear differentiator. Ultimately, successful digital assets are not built on ideas alone, but on execution, iteration, and responsiveness to user needs.

Risk Control: Protecting Your Income Engine

No passive income strategy is worthwhile if it exposes you to catastrophic loss. High returns mean little if volatility wipes out your principal or forces you to abandon your plan during a downturn. That’s why risk control is not an afterthought—it’s the foundation of sustainable income. My approach centers on capital preservation, diversification, and clear decision rules. These safeguards don’t eliminate risk, but they reduce its impact and increase the likelihood of long-term success.

Diversification is the first line of defense. Spreading investments across asset classes—stocks, bonds, real estate, and digital ventures—reduces dependence on any single source of income. Within each category, further diversification matters. Instead of owning one dividend stock, I hold a basket across sectors. Rather than investing in a single REIT, I allocate across property types and regions. This way, if one sector underperforms—such as retail real estate during a shopping downturn—others can offset the loss. Diversification doesn’t guarantee profits, but it smooths the ride.

Position sizing is equally important. I avoid putting too much capital into any one investment, typically limiting individual holdings to 3–5% of the total portfolio. This prevents a single failure from causing irreversible damage. For example, even if a promising tech startup I backed fails, the loss is contained. Similarly, if a dividend stock cuts its payout, the overall income stream remains stable thanks to other contributors. This disciplined allocation allows for calculated risks without jeopardizing financial security.

Setting clear exit rules is another critical practice. Emotions can cloud judgment, especially during market stress. To counter this, I define in advance the conditions under which I will sell an asset. This might include a dividend cut, a fundamental deterioration in financial health, or a valuation that becomes excessively high. Having these rules written down removes hesitation and prevents holding onto losers out of hope. It also protects gains by locking in profits when an asset reaches its target price.

Finally, I stress-test my portfolio regularly. This involves simulating adverse scenarios—such as a 30% market drop, rising interest rates, or a recession—and assessing how each income source would perform. If the projected outcome threatens my lifestyle or goals, I adjust allocations accordingly. This proactive review ensures my strategy remains robust under pressure. Risk control isn’t about avoiding all losses—it’s about managing them so they don’t derail the bigger picture.

Putting It All Together: Building a Resilient Income Portfolio

True financial freedom comes not from chasing the highest possible return, but from constructing a balanced, adaptive income portfolio. My approach combines multiple streams—dividend stocks, REITs, digital ventures, and fixed-income instruments—each playing a specific role. The goal is not maximum yield, but consistent, reliable cash flow that can support living expenses, reinvestment, and peace of mind. This requires intentional design, ongoing monitoring, and periodic rebalancing to reflect changing market conditions.

I begin by defining my income needs—how much I want to generate annually and from which sources. Then, I allocate capital based on risk tolerance, time horizon, and market outlook. For example, in a rising rate environment, I might increase allocations to short-duration bonds and floating-rate loans, which benefit from higher yields. During periods of economic uncertainty, I emphasize defensive sectors like healthcare and consumer staples. When growth accelerates, I allow more exposure to innovative digital platforms with strong scalability.

Each asset class complements the others. Dividend stocks provide growth potential and inflation protection. REITs offer tangible asset exposure and high yields. Digital ventures contribute scalability and innovation upside. Fixed-income investments add stability and predictability. Together, they form a self-reinforcing system where strength in one area can compensate for weakness in another. This interconnected structure enhances resilience and reduces reliance on any single market outcome.

Rebalancing is key to maintaining balance. I review my portfolio at least twice a year, adjusting allocations if any category drifts significantly from its target weight. For instance, if tech stocks surge and now represent 40% of my equity holdings instead of the intended 25%, I trim the position and reinvest in underweight areas. This disciplined approach locks in gains and restores diversification, preventing emotional overcommitment to hot sectors.

Ultimately, building passive income is a long-term endeavor. It requires patience, education, and a willingness to adapt. There will be market downturns, unexpected disruptions, and moments of doubt. But with a well-structured, risk-aware strategy, you can create a financial foundation that generates income year after year. This isn’t about getting rich overnight—it’s about gaining control, reducing stress, and creating lasting freedom. By focusing on smart, market-informed decisions, you can build a portfolio that works for you, not against you, and stands the test of time.