How I Mastered My Moving Expenses Without Killing My Investment Flow

Moving shouldn’t wreck your financial rhythm. Yet, every time I relocated, I ended up draining my savings, derailing my investments, and stressing over hidden costs. Sound familiar? What if you could cover your move smoothly while keeping your money working for you? This is the real talk on balancing moving expenses with smart investing—no fluff, no jargon, just practical steps I’ve tested and trusted to protect both your cash and your long-term goals. The truth is, most people treat moving as a one-off expense, like buying new furniture or renovating a kitchen. But it’s more than that. It’s a financial pivot point—one that can either disrupt your wealth-building trajectory or become a catalyst for smarter money habits. With the right planning, you don’t have to choose between a smooth transition and staying on track with your investments.

The Hidden Cost of Moving: More Than Just Boxes and Trucks

When most people think about moving expenses, they picture truck rentals, packing supplies, and maybe a few takeout meals during the chaos. But the real cost of relocation goes far beyond these obvious line items. There are dozens of smaller, often overlooked charges that quietly accumulate and can add up to thousands of dollars. Security deposits for new rentals, utility setup fees for electricity, water, gas, and internet, pet deposits if you have animals, and even parking permits in urban neighborhoods—all of these fall outside the typical moving budget. Then there are the costs tied to timing: temporary housing if your new place isn’t ready, storage unit rentals if you need to bridge a gap between leases, or last-minute cleaning services to meet move-out requirements at your old home.

Equally important are the indirect financial impacts. Changing addresses and setting up new services can affect your credit utilization and payment history if not managed carefully. For example, failing to close out old utility accounts or missing a payment during the transition could result in a negative mark on your credit report. A lower credit score doesn’t just affect loan approvals—it can increase interest rates on credit cards and mortgages, costing you more over time. These ripple effects mean that a poorly managed move doesn’t just deplete cash; it can also weaken your overall financial health.

Another often-ignored factor is the emotional tax of financial stress during a move. When unexpected bills pop up, many people turn to credit cards or personal loans to cover them. This can lead to high-interest debt that lingers long after the boxes are unpacked. The key is to recognize that moving is not just a logistical challenge but a full financial event. Treating it as such allows you to plan holistically, anticipate these hidden costs, and protect your investment momentum. By mapping out every possible expense in advance—even those that seem minor—you gain control over your cash flow instead of reacting to surprises.

One practical way to do this is by creating a comprehensive moving cost checklist. Start with the big-ticket items: professional movers or rental trucks, travel costs if moving long distance, and deposits. Then layer in the smaller but frequent expenses: new household essentials like curtains, light bulbs, or kitchenware that may not transfer with you. Don’t forget insurance considerations—renter’s insurance for your new place, or increased coverage if you’re moving into a higher-risk area. The goal isn’t to predict every dollar with perfect accuracy, but to build a realistic picture of what’s coming so you can prepare without panic.

Why Your Investment Rhythm Matters More During Life Transitions

Life transitions—like moving, changing jobs, or starting a new chapter—often come with financial disruptions. One of the most damaging habits is pausing investments during these times. It feels logical: money is tight, unexpected costs arise, so you hit pause on contributions to your retirement accounts or brokerage funds. But this short-term fix can have long-term consequences. The power of compound growth relies on consistency. Even a few months off track can reduce your final portfolio value by tens of thousands of dollars over decades.

Think of investing like maintaining a steady heartbeat. When you skip contributions, it’s like missing beats. The body can handle brief pauses, but repeated interruptions weaken the system. In financial terms, every dollar not invested today loses the opportunity to grow over time. For example, if you normally contribute $500 per month to a retirement account earning an average annual return of 7%, skipping just six months means you’re not only losing $3,000 in contributions—you’re also losing the compounded growth those dollars would have generated over the next 20 or 30 years. That lost growth can easily exceed $10,000, depending on market performance and time horizon.

This is why maintaining your investment rhythm during a move—or any major life change—is so critical. It’s not about investing large sums under pressure; it’s about preserving the habit and discipline that drive long-term success. Even reducing contributions temporarily, rather than stopping altogether, can make a significant difference. For instance, dropping from $500 to $200 per month keeps your account active, maintains your relationship with the market, and avoids the psychological hurdle of restarting later.

Another benefit of staying invested is behavioral. When you keep contributing—even in smaller amounts—you reinforce a mindset of financial resilience. You’re signaling to yourself that life changes don’t have to derail your goals. This mental framework helps prevent emotional decision-making, like selling investments at a loss during market dips or overspending out of stress. Instead, you remain anchored to your long-term vision. The message is clear: transitions are inevitable, but your financial strategy doesn’t have to be reactive. By protecting your investment rhythm, you ensure that temporary changes don’t become permanent setbacks.

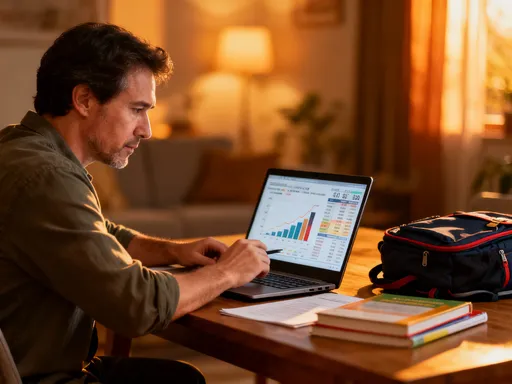

Building a Move-Resilient Financial Plan: Aligning Cash Flow with Goals

A successful move isn’t just about hiring good movers or packing efficiently—it’s about financial preparedness. The foundation of a move-resilient plan is forecasting. Ideally, you should begin assessing potential moving costs at least three to six months in advance. This timeline gives you enough space to save deliberately, adjust your budget, and avoid last-minute financial strain. Start by researching average costs in your new location, especially for housing, utilities, and transportation. If you’re moving to a city with a higher cost of living, those differences need to be reflected in your planning.

Next, categorize your expenses into essentials and non-essentials. Essentials include security deposits, utility setup fees, moving services, and basic household items you’ll need immediately. Non-essentials might be decorative furnishings, upgraded appliances, or premium internet packages. Being clear about this distinction helps you prioritize spending and avoid inflating your moving budget with wants disguised as needs. It also makes it easier to identify where you can cut back if necessary.

One of the most effective strategies is creating a dedicated transition buffer. This is a separate savings fund specifically for life changes like moving, job transitions, or family expansions. Unlike your emergency fund—which is meant for true crises like medical bills or job loss—the transition buffer is for anticipated but irregular expenses. By keeping this money in a high-yield savings account or short-term certificate of deposit, you earn modest returns while maintaining liquidity. Importantly, this buffer exists outside your investment accounts, so you’re not forced to sell stocks or mutual funds at an inopportune time to cover moving costs.

Integrating this buffer into your broader financial strategy ensures alignment between your short-term needs and long-term goals. For example, if you know a move is coming in nine months, you can start allocating a portion of your monthly income toward the buffer. This gradual buildup reduces the shock to your cash flow when the time comes. It also allows you to maintain consistent contributions to your retirement and investment accounts, preserving your wealth-building momentum. A move-resilient plan isn’t about doing more with less—it’s about doing the right things at the right time.

Smart Timing: When to Spend, When to Invest, and When to Wait

Timing is one of the most powerful tools in personal finance, yet it’s often overlooked during major transitions. The way you time your move can significantly impact both your immediate costs and your long-term financial health. One of the smartest moves is aligning your relocation with predictable income events, such as annual bonuses, tax refunds, or seasonal earnings peaks. Receiving a lump sum around the same time as your move reduces the need to borrow or dip into savings, allowing you to cover expenses without disrupting your investment flow.

Another timing strategy involves adjusting the schedule of your move itself. If your lease allows flexibility, consider shifting your move-in date to avoid peak rental seasons. In many cities, rental prices spike in the summer months due to high demand from students and families. Moving in late fall or winter could save hundreds per month on rent, which adds up over the course of a year. Similarly, booking movers several weeks in advance—rather than during a holiday weekend or month-end rush—can result in lower rates and better service availability.

On the investment side, timing means knowing when to hold off on large purchases or contributions. For instance, if you’re planning a significant investment in the stock market or real estate, it may make sense to delay that decision until after your move is complete and your finances have stabilized. This prevents overextension and ensures you’re making decisions from a place of clarity, not stress. Conversely, there are moments when accelerating certain actions makes sense—like locking in a fixed-rate mortgage or signing a long-term lease at a favorable rate before market conditions change.

The key is intentionality. Every financial decision during a transition should be evaluated not just on its immediate impact, but on how it affects your overall financial rhythm. That means asking questions like: Does this expense require me to pause investing? Could I delay this purchase without causing inconvenience? Is there a lower-cost alternative that still meets my needs? By applying these filters, you make trade-offs that support both stability and growth. Smart timing isn’t about waiting for the perfect moment—it’s about making the most of the moment you’re in.

Cutting Costs Without Cutting Corners: Practical Moves That Save Real Money

Reducing moving expenses doesn’t require extreme frugality or sacrificing comfort. It’s about making smarter choices that preserve capital without compromising quality. One of the most effective strategies is decluttering before you pack. The less you own, the less you have to move—and the lower your overall costs. Selling or donating unwanted items not only lightens your load but can also generate extra cash to offset moving expenses. This approach turns waste into value, and every box you eliminate translates into real savings on transportation and labor.

Another powerful cost-saving tool is comparison shopping for movers. Many people accept the first quote they receive, but prices can vary widely between companies. Using digital platforms to compare multiple bids side by side helps you find reliable services at competitive rates. Look beyond the bottom line—check customer reviews, verify insurance coverage, and confirm what’s included in the quote. A slightly higher price might be worth it for better service and fewer surprises. Some companies even offer discounts for off-peak moves, referrals, or military service, so always ask about available promotions.

Negotiating lease terms is another often-overlooked opportunity to save. Landlords may be willing to reduce or waive application fees, offer a free month of rent, or include utilities in the lease—especially if the unit has been vacant for a while. Even small concessions can add up. For example, having internet or trash service included can save $50 to $100 per month. If you’re signing a longer lease, use that commitment as leverage to negotiate better terms. These savings free up cash that can be redirected toward investments or added to your transition buffer.

Other practical tips include using free packing supplies—many grocery and liquor stores give away sturdy boxes—and packing room by room to avoid over-packing. Cooking meals at home before the move instead of eating out reduces expenses and minimizes last-minute stress. Digital tools like moving checklists, budget trackers, and inventory apps help you stay organized and avoid duplicate purchases in your new home. Each of these actions may seem small on its own, but together they create a significant financial cushion. The goal isn’t to eliminate all spending—it’s to spend wisely so your money continues working for you.

Protecting Your Portfolio: Risk Control When Liquidity Is Tight

When cash flow tightens during a move, the temptation to tap into investment accounts increases. After all, the money is there, visible in your brokerage dashboard, and it feels like an easy solution to cover unexpected costs. But withdrawing from investments—especially during market downturns or periods of volatility—can do long-term damage. Selling low locks in losses, and even selling during stable times means losing future growth potential. Protecting your portfolio during transitions requires discipline, clear rules, and alternative strategies for managing liquidity.

One essential safeguard is defining strict guidelines for when you’ll access investment funds. A good rule of thumb is to treat your portfolio like a retirement vault: it’s off-limits except for true financial emergencies. A move, no matter how stressful, is not an emergency in this context. Instead, rely on your transition buffer and emergency fund to cover relocation costs. If you haven’t built these yet, start now—even small monthly contributions add up over time. Having these dedicated funds removes the pressure to make emotional decisions under financial strain.

For those who need temporary access to cash, consider low-volatility assets as a parking spot for move-related funds. High-yield savings accounts, money market funds, or short-term bonds offer modest returns with minimal risk. These vehicles provide liquidity without exposing you to market swings. You can transfer funds in and out as needed, then reinvest once your move is complete and your budget stabilizes. This approach maintains flexibility while protecting your core investment strategy.

Another layer of protection is maintaining a diversified portfolio. When your investments are spread across different asset classes—stocks, bonds, real estate investment trusts, and cash equivalents—you reduce the risk of being forced to sell in a downturn. Diversification helps smooth out volatility, so even if one part of your portfolio dips, others may hold steady or rise. This stability gives you more confidence to stay the course during transitions. Remember, the goal isn’t to avoid all risk—it’s to manage it wisely so you can keep building wealth over time.

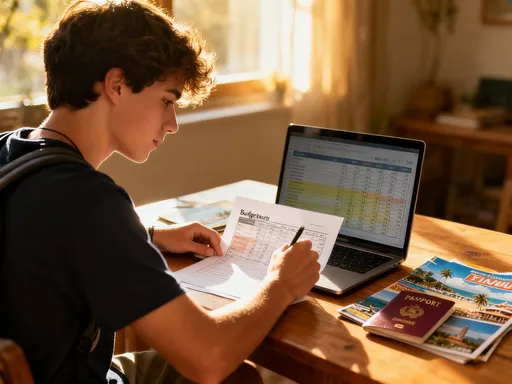

Getting Back on Track: Rebuilding Investment Momentum After the Move

The final phase of a successful move isn’t unpacking the last box—it’s restarting your financial engine. Once you’re settled, it’s time to reassess your budget, recommit to your goals, and reactivate your investment plan. This post-move review is crucial. Your income, expenses, and lifestyle may have changed, so your financial strategy should reflect that new reality. Start by updating your monthly budget with your new rent, utility costs, transportation expenses, and any other changes. This gives you a clear picture of your current cash flow and helps you determine how much you can realistically allocate to savings and investments.

Next, revisit your financial goals. Has the move brought new opportunities or challenges? Maybe you’re closer to work and saving on commuting costs, or perhaps you’re in a higher-tax area that affects your disposable income. Adjust your targets accordingly, but don’t lose sight of the long-term vision. If you reduced contributions during the move, now is the time to ramp them back up. Even increasing by $50 or $100 per month can reignite your momentum. The key is consistency, not perfection.

Consider setting a “rebuild period” of three to six months where you focus on restoring your previous contribution levels. During this time, prioritize investments over discretionary spending. Automate your contributions if possible, so they happen without requiring constant attention. Automation removes the mental burden and ensures you stay on track even when life gets busy. You might also take this opportunity to rebalance your portfolio, ensuring your asset allocation still aligns with your risk tolerance and time horizon.

Finally, reflect on what you learned from the experience. Did you uncover unexpected costs? Were there areas where you overspent or saved more than expected? Use these insights to improve your planning for future transitions. A move doesn’t have to be a financial setback—it can be a reset point. By applying what you’ve learned, you emerge not just in a new home, but with a stronger, more informed approach to managing money. The goal is to turn every life change into a step forward, not a pause in your journey toward financial independence.